特惠-26考研冲刺

特惠-27考研课

双证-在职硕士

免联考-同等学力

复试分数线

26复试全面指导

模拟复试面试

26考研-全套真题

26考研估分

保研-路线图

27考研-智能择校

27考研-英语测评

27考研-新大纲对比

热门-计算机择校

扫码加入训练营

牢记核心词

学习得礼盒

2015考研英语复习正是强化复习阶段,考研英语阅读在考研英语中占了40分,所以考研英语阅读是英语科目中重要的一项。新东方名师范猛老师曾建议过考研生需要坚持每天泛读10-15分钟的英文原刊。强烈推荐了杂志《经济学人》.杂志中的文章也是考研英语的主要材料来源.希望考研考生认真阅读,快速提高考研英语阅读水平。

Sound the retreat

鸣金收兵

Profits in America may have peaked for this cycle

美国公司的利润可能已达到本周期内的最高值

ARE corporate profits at last running out of steam?The lead-up to the first-quarter results season onWall Street was marked by an unusually large number of profit warnings, such as that fromChevron, an oil group. According to Morgan Stanley, an investment bank, earnings estimatesfor S&P 500 companies were revised down by 4.4 percentage points in the first quarter.

公司的利润最终失去势头了么?即将到来的华尔街第一季度财报季中,包括石油集团雪福龙在内的异常多的盈利警告成为了显著特征。根据投行摩根史坦利的说法,第一季度标普500指数成分股公司的盈利预期被调低了4.4个百分点。

As is the custom, having lowered the bar, companies will now beat those revised forecasts,allowing Wall Street analysts to proclaim a “successful” results reason. But when oneremoves the effect of exceptional items, American profits are now falling, not rising,according to data from MSCI.

按照惯例,各公司降低了标准后,现在能击败了那些调低的预测值,并使得华尔街分析师们纷纷赞扬这个“成功的”财报季。但根据来自MSCI的数据,一旦排除掉那些例外事项的影响,美国公司的利润现在正在下滑,而非上升。

In a sense, this is about time. The recovery in American corporate profits since therecession has been remarkable: they are close to a post-war high as a proportion of GDP.Bulls have a number of arguments why this is a lasting, not cyclical, phenomenon.Economic power has shifted from labour to capital thanks to globalisation, they say;companies can move production to parts of the world where wages are lower. But if thateffect is so strong, why aren’t profits as high elsewhere? In Britain the return on corporatecapital is below its post-1997 average.

从某种意义上讲,现在确实到时候了。自经济衰退以来,美国公司的利润复苏取得了显著进展:其占GDP的比重已接近了二战之后的最高值。对行情持乐观态度的人们有着一大堆的理由来解释为何这是一种持续性现象,而非周期性现象。他们表示,全球化使得经济实力从劳动力转移到了资本;公司可以把生产转移到世界上那些工资更低的地区。但是,如果这种效应如此强烈,为何其他地区公司的利润没有这么高?英国的资本收益率已低于其1997年以后的平均水平。

An alternative, but related, line of reasoning is that foreign profits have boosted theearnings of companies in the S&P 500, making the relationship with domestic GDP lessrelevant. America may still be running a trade deficit but its global champions, theargument runs, are raking in the money overseas. Research by Audit Analytics found that theamount of profits held abroad and not repatriated nearly doubled to 2.1 trillion between 2008and 2013.

另一种与此有关联的推测在于,国外利润提升了标普500指数成分股公司的总体收益,使得后者与国内GDP的相关性更低。美国可能仍存在贸易赤字,但是如本观点所说,其国际领军企业在海外赚了不少钱。Audit Analytics研究发现,2008-2013年间,海外获得且尚未汇回的利润数达到了2.1万亿美元,几乎翻了一番。

But where will American multinationals make so much money in future? Not in either Europeor Japan, where the economies have barely grown in recent years. Emerging markets mightseem more promising, but their economies have been slowing, as companies like Diageo, adrinks producer, and Cisco, a tech-components group, have reported. Several developingeconomies have seen their currencies fall sharply too. It seems unlikely that Americanmultinationals are going to get a further spurt of profits from this source.

但是,将来美国的跨国公司还能从哪儿赚到这么多钱呢?不会是欧洲或是日本,因为近些年它们的经济几乎没有增长。新兴市场可能看上去更有前景,但鉴于诸如饮料生产企业帝亚吉欧和技术元件集团思科等公司已经发布的数据,它们的经济也已放缓。一些发展中经济体也已目睹了本国货币大幅下降。似乎美国的跨国公司不可能再从这个源头得到进一步的井喷式利润增长。

In any case, the global data do not bear out the overseas-profit argument. Just as inAmerica, there have been regular disappointments. In 2012, according to Citibank, globalprofits growth was just 2%, compared with initial forecasts of 11%. At the start of 2013profits were forecast to rise by 12%; the actual increase was 7%.

无论如何,全球的数据并不支持“海外利润”理论。正如在美国,也已出现了常见的令人失望的结果。根据花旗银行结论,2012年全球利润增长率仅为2%,相比之下,初步预测可是到了11%。2013年初,利润预测增长12%,但实际增长仅为7%。

The stockmarket has been remarkably resilient in the face of these setbacks. In 2012 globalequities rose by 13%; last year they managed 24%. In part, that is due to optimism aboutthe economy’s future trajectory. The euro-zone crisis has disappeared from the headlineswhile the American economy has been showing signs of returning to healthy growth.

面临着这些波折时,股市已表现出极强的弹性。2012年全球股票增长了13%;去年增长了24%。在某种程度上,这要归因于对经济未来发展轨迹的乐观情绪。欧元区金融危机已从新闻头条上消失,同时美国经济也已出现了回归健康增长的迹象。

But it is also down to supportive monetary policy. Short-term interest rates have not budgedfor the past two years (in the developed world) and government-bond yields have been closeto historic lows. Investors have accordingly turned to the stockmarket in search of higherreturns. Low interest rates have also played their part in keeping profits high, by reducingborrowing costs and by encouraging companies to use their spare cash to buy back stock,thereby increasing earnings per share.

但它同样是支持性货币政策所起的作用。过去两年短期利率一直没有变化,政府债券收益率也接近了历史最低水平。投资者相应地转向股票市场寻求更高回报。低利率通过降低借款成本、鼓励公司使用闲置资金回购股票,在提升利润方面起到了一定作用,也由此提高了每股收益。

However, buying back shares suggests a certain lack of imagination on the part of chiefexecutives, or a lack of profitable projects to back. That remains an odd aspect of the profitsboom: in theory, if the return on capital is high, one would expect a lot of capital to beinvested. The resulting competition would eventually cause profits to fall. The process actsas a natural check on profits growth, but has yet to occur this cycle.

然而,回购股票表明了首席执行官在一定程度上缺乏前景设想,或公司缺少需要支持的盈利项目。利润丰厚的现象中仍存在一个奇怪之处:理论上,如果资本收益率很高,人们将期望能拥有大量可供投资的资本,由此导致的竞争将最终导致利润下滑。这一过程是对利润增长率的一种自然而然的检验,但本周期内尚未出现。

Instead, chief executives are turning to that old device for boosting sluggish profits:takeovers. According to Thomson Reuters, the global value of mergers and acquisitions inthe first quarter was 36% higher than in the same period of 2013. The right takeover canresult in cost cuts through economies of scale—although in the long run, the academicevidence in favour of takeovers is mixed.

相反地,首席执行官们正在转向“收购”这一陈旧手段来刺激缓慢增长的利润。根据汤森路透的结果,第一季度全球的并购价值比2013年同期高出了36%。适宜的收购能通过规模经济实现成本削减——但是长远来看,支持收购的学术证据比较混杂。

A takeover boom is a classic signal of the final stages of a bull market, a sign that financialengineering has taken over from genuine business expansion. And that is hardly a surprise:the current rally is already the fourth-largest and the fifth-longest-running since 1928.

收购热潮是牛市最后阶段的一个典型信号,这一信号表明,金融运作已经接替了真正的业务扩张。而且这不奇怪:当前这已经是1928年以来第四次最大规模、第五次持续时间最长的反弹了。

词语解释

1.run out of 用完;耗尽

Should they run out of battery charge half-way totheir destination, what will they do?

如果他们汽车上的电池在半路上用完电,他们该怎么办?

It will run out of money this year without freshcash, and markets are charging punitive rates forborrowing.

它会在今年把钱用完,又没有新的现金注入,而市场也在对贷款收取惩罚性利率。

2.such as 例如;譬如;诸如

The printers can also create interlocking mechanical parts, such as gears and cogs.

3D打印机也可以制造出具有连锁机制的零部件,比如齿轮和接榫等。

It made money on institutional client services, such as executing trades.

机构客户服务(如执行交易)也实现了盈利。

3.according to 根据,按照;据…所说

All firsts in a car, according to gm.

据通用公司表示,这些都是汽车史上的头一遭。

According to weiner, product teams will continue to crank.

据韦纳尔表示,产品团队将继续发挥奇思妙想。

4.shift from 转向

Energy efficiency will also suffer as people shift from mass transit.

由于人们的出行从公交方式转向私家车,能源效益也将受到影响。

Regulators are also increasingly pushing insurers to shift from relentless growth tosustainable profitability.

监管机构也越来越多地推动保险公司从无情的增长转向可持续的盈利能力。

八月伊始,部分高校2015年考研招生简章已经发布,请广大15年考生关注,预计到8月底9月初,2015年全国硕士研究生招生简章会陆续发布完成,新东方在线小编第一时间跟踪发布,请大家收藏关注!另有研究生专业目录、考研参考书等最新考研信息,帮助考生及时了解目标院校招生政策及信息。

新东方名师考研课程直播 购买进行中

【英语阅读资料】这里有↑↑↑

资料下载

资料下载

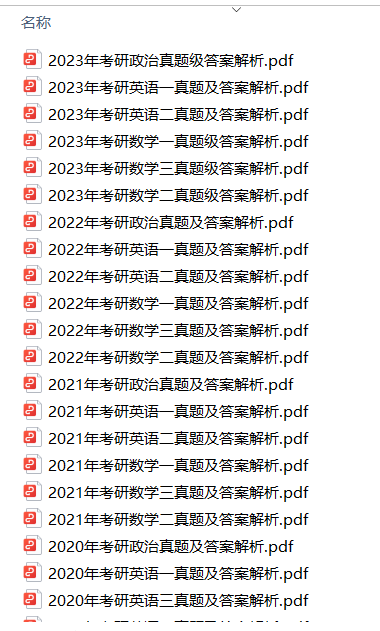

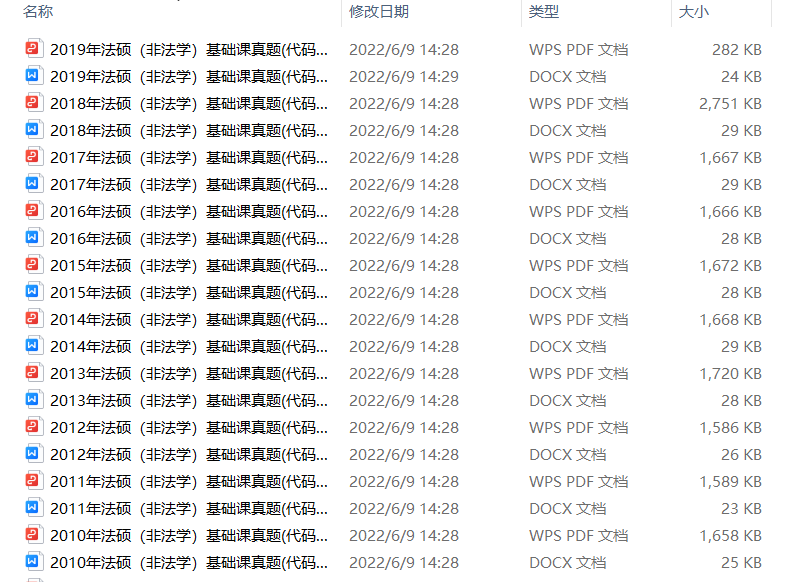

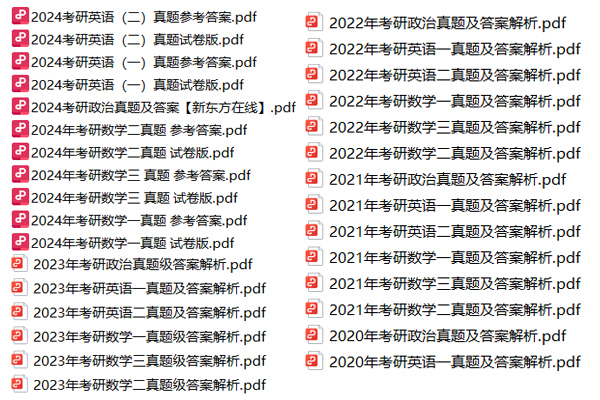

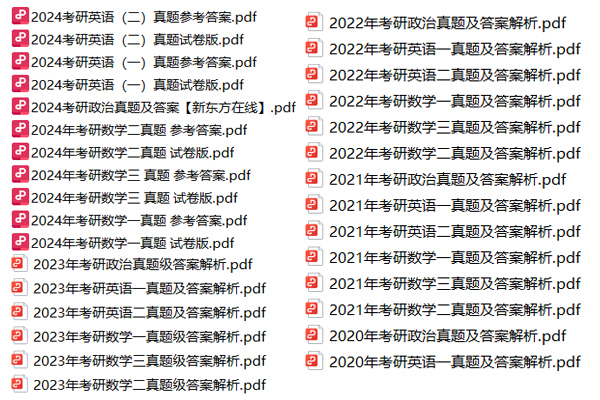

2014年-2025年考研历年真题汇总

发布时间:2024-04-25扫码添加【考研班主任】

即可领取资料包

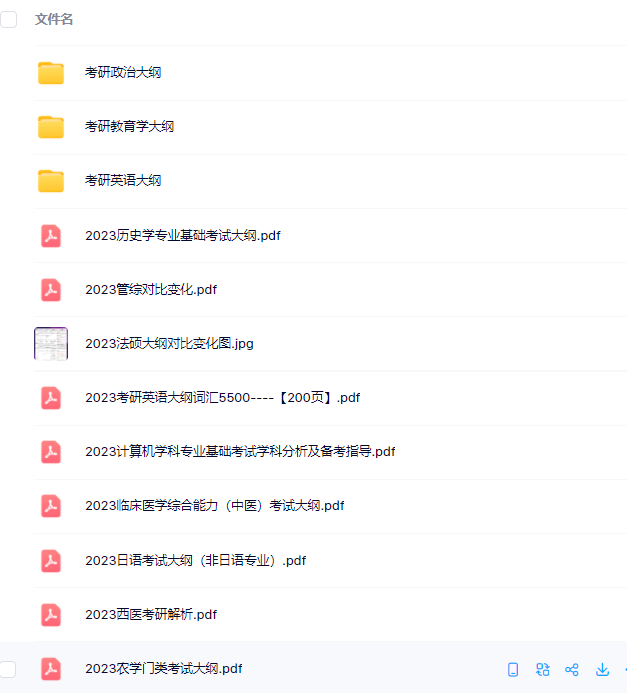

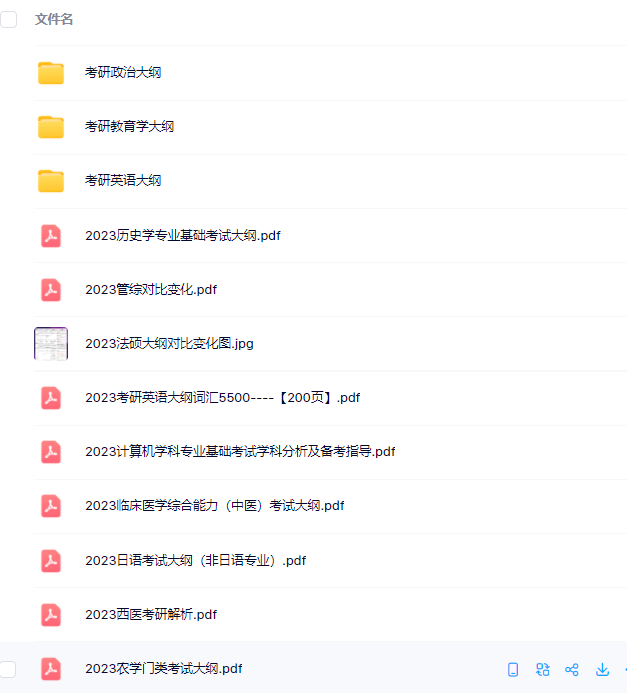

考研大纲PDF电子版下载-历年(附解析)

发布时间:2024-04-25扫码添加【考研班主任】

即可领取资料包

2026年考研政数英备考资料zip压缩包

发布时间:2024-04-25扫码添加【考研班主任】

即可领取资料包

考研英语大纲词汇5500打印版(基础必备)

发布时间:2024-04-25扫码添加【考研班主任】

即可领取资料包

新东方在线考试模拟题【12套】

发布时间:2024-04-25扫码添加【考研班主任】

即可领取资料包

2026年考研专业课知识点总结

发布时间:2024-04-25扫码添加【考研班主任】

即可领取资料包

新东方考研资料下载地址

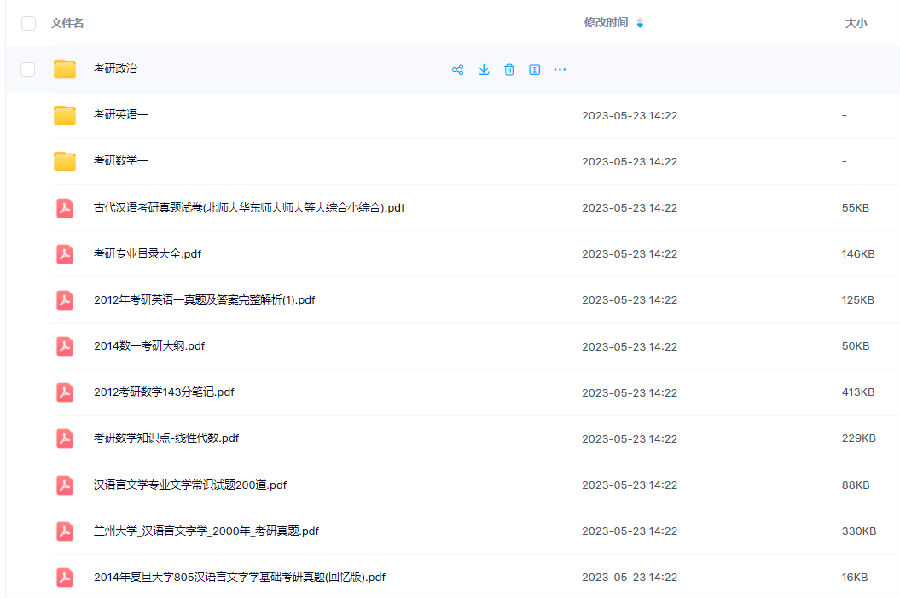

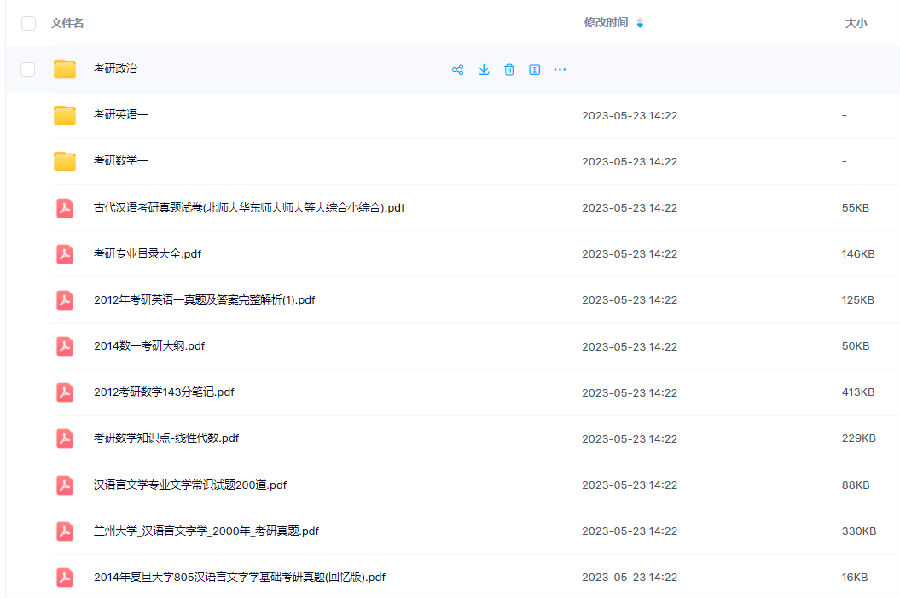

发布时间:2023-05-17新东方在线考研资料合集

下载方式:微信扫码,获取网盘链接

目录:

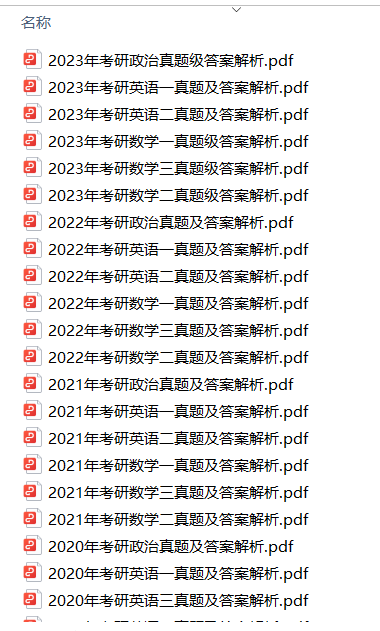

1.2013-2023年近10年政数英真题及解析PDF版(新东方)

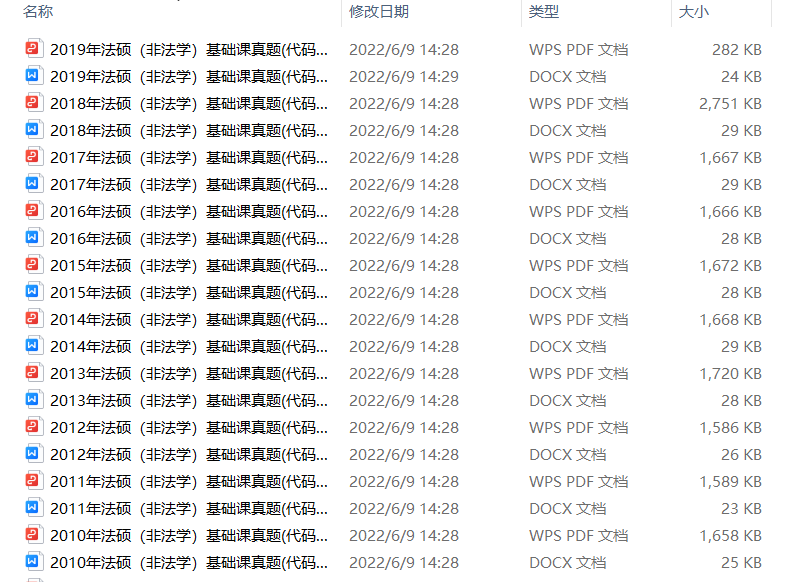

2.2013-2023年专业课考试历年真题及解析PDF版

3.24考研复习备考资料大合集:大纲+备考资料+词汇书+考前押题+自命题

资料介绍:

1.2013-2023年近10年政数英真题及解析PDF版(新东方)

、

、

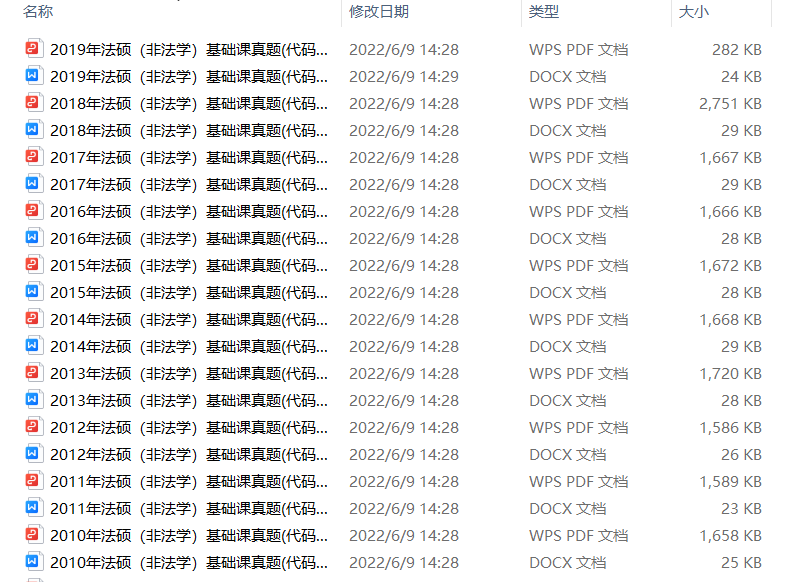

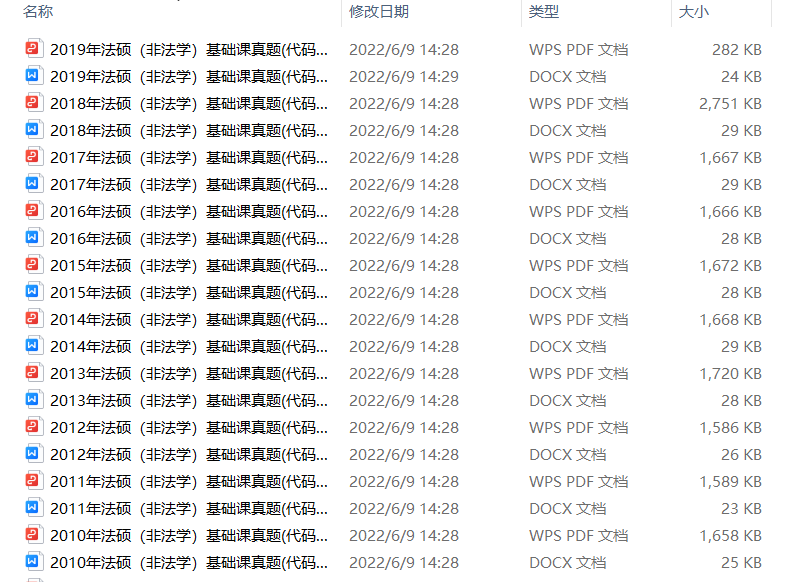

2.2013-2023年专业课考试历年真题及解析PDF版

3.24考研复习备考资料大合集

3.24考研复习备考资料:考研大纲

3.24考研复习备考资料:政数英备考资料+自命题真题

------------------

考研备考过程中,尤其是专业课部分,参考往年的考试真题,对于我们的复习有更好的帮助。北京大学考研真题资料都有哪些?小编为大家进行了汇总。

北京大学考研真题资料-公共课

北京大学考研真题资料-专业课

以上就是关于“北京大学考研真题资料下载(历年汇总)”的整理,更多考研资料下载,请关注微信获取下载地址。

2024考研公共课必背知识点汇总

发布时间:2023-01-03扫码添加【考研班主任】

即可领取资料包

2013-2023考研历年真题汇总

发布时间:2023-01-03扫码添加【考研班主任】

即可领取资料包

考研英语大纲词汇(PDF可打印)

发布时间:2023-01-03扫码添加【考研班主任】

即可领取资料包

2024考研专业课知识点总结

发布时间:2023-01-03扫码添加【考研班主任】

即可领取资料包

2023考研政治 内部押题 PDF

发布时间:2022-11-16扫码添加【考研班主任】

即可领取资料包

徐涛:23考研预测六套卷

发布时间:2022-11-16扫码添加【考研班主任】

即可领取资料包

考研政数英冲刺资料最新整理

发布时间:2022-11-16扫码添加【考研班主任】

即可领取资料包

23考研答题卡模板打印版

发布时间:2022-11-16扫码添加【考研班主任】

即可领取资料包

2023考研大纲词汇5500PDF电子版

发布时间:2022-07-28扫码添加【考研班主任】

即可领取资料包

考研历年真题(公共课+专业课)

发布时间:2022-07-28扫码添加【考研班主任】

即可领取资料包

考研英语阅读100篇附解析及答案

发布时间:2022-01-07扫码添加【考研班主任】

即可领取资料包

新东方考研学霸笔记整理(打印版)

发布时间:2022-01-07扫码添加【考研班主任】

即可领取资料包

2001-2021年考研英语真题答案(可打印版)

发布时间:2022-01-07扫码添加【考研班主任】

即可领取资料包

考研英语词汇5500(完整版下载)

发布时间:2022-01-07扫码添加【考研班主任】

即可领取资料包

2022考研政审表模板精选10套

发布时间:2022-01-07扫码添加【考研班主任】

即可领取资料包

历年考研真题及答案 下载

发布时间:2021-12-09扫码添加【考研班主任】

即可领取资料包

考研政审表模板汇总

发布时间:2020-06-17扫码添加【考研班主任】

即可领取资料包

近5年考研英语真题汇总

发布时间:2020-06-17扫码添加【考研班主任】

即可领取资料包

考研英语大纲词汇5500

发布时间:2020-06-17扫码添加【考研班主任】

即可领取资料包

2022考研12大学科专业排名汇总

发布时间:2019-11-21扫码添加【考研班主任】

即可领取资料包

2023考研政治复习备考资料【珍藏版】

发布时间:2019-11-21扫码添加【考研班主任】

即可领取资料包

考研英语万能模板+必备词汇+范文

发布时间:2019-11-21扫码添加【考研班主任】

即可领取资料包

考研数学一、二、三历年真题整理

发布时间:2019-11-21扫码添加【考研班主任】

即可领取资料包

添加班主任领资料

添加考研班主任

免费领取考研历年真题等复习干货资料

推荐阅读

推荐阅读

为了让考研的同学更高效地复习考研英语,新东方在线考研频道整理了“考研英语1阅读错几个后的复习计划”,考研的同学可以了解一下,希望对大家有所帮助。

为了让考研的同学更高效地复习考研英语,新东方在线考研频道整理了“考研英语二阅读篇数及题型分析”,考研的同学可以了解一下,希望对大家有所帮助。

为了让考研的同学更高效地复习考研英语,新东方在线考研频道整理了“考研英语阅读理解的总结与反思”,考研的同学可以了解一下,希望对大家有所帮助。

来源 : 网络 2025-06-13 08:02:00 关键字 : 考研英语阅读理解

为了让考研的同学更高效地复习考研英语,新东方在线考研频道整理了“提高考研英语一阅读理解的五大策略”,考研的同学可以了解一下,希望对大家有所帮助。

为了让考研的同学更高效地复习考研英语,新东方在线考研频道整理了“探索考研英语阅读文章的逻辑结构”,考研的同学可以了解一下,希望对大家有所帮助。

来源 : 网络 2025-06-12 08:03:00 关键字 : 考研英语阅读

资料下载

资料下载

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

新东方在线考研资料合集

下载方式:微信扫码,获取网盘链接

目录:

1.2013-2023年近10年政数英真题及解析PDF版(新东方)

2.2013-2023年专业课考试历年真题及解析PDF版

3.24考研复习备考资料大合集:大纲+备考资料+词汇书+考前押题+自命题

资料介绍:

1.2013-2023年近10年政数英真题及解析PDF版(新东方)

、

、

2.2013-2023年专业课考试历年真题及解析PDF版

3.24考研复习备考资料大合集

3.24考研复习备考资料:考研大纲

3.24考研复习备考资料:政数英备考资料+自命题真题

------------------

考研备考过程中,尤其是专业课部分,参考往年的考试真题,对于我们的复习有更好的帮助。北京大学考研真题资料都有哪些?小编为大家进行了汇总。

北京大学考研真题资料-公共课

北京大学考研真题资料-专业课

以上就是关于“北京大学考研真题资料下载(历年汇总)”的整理,更多考研资料下载,请关注微信获取下载地址。

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

阅读排行榜

阅读排行榜

相关内容

相关内容