特惠-26考研冲刺

特惠-27考研课

双证-在职硕士

免联考-同等学力

复试分数线

26复试全面指导

模拟复试面试

26考研-全套真题

26考研估分

保研-路线图

27考研-智能择校

27考研-英语测评

27考研-新大纲对比

热门-计算机择校

扫码加入训练营

牢记核心词

学习得礼盒

2015考研英语复习正是强化复习阶段,考研英语阅读在考研英语中占了40分,所以考研英语阅读是英语科目中重要的一项。新东方名师范猛老师曾建议过考研生需要坚持每天泛读10-15分钟的英文原刊。强烈推荐了杂志《经济学人》.杂志中的文章也是考研英语的主要材料来源.希望考研考生认真阅读,快速提高考研英语阅读水平。

apanese banks in Asia;Lending a hand;

亚洲日本银行;伸出援手;

Japan's biggest banks help pick up the slack fromretreating Europeans;

日本大型银行捡起了欧洲人撂下的担子;

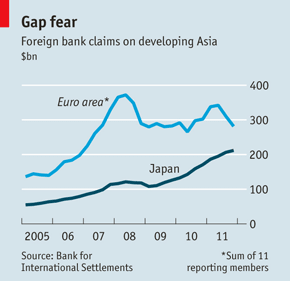

There are two, potentially overlapping, ways in which Asia's export-driven economies couldsuffer from the euro crisis. One is from the slowdown in trade to Europe. The other is thedrying up of finance, from trade credit to syndicated loans, extended by euro-zone banks.On neither score is Asia as vulnerable as it was after the collapse of Lehman Brothers in2008, argued Iwan Azis of the Asian Development Bank, at The Economist's Bellwetherconference in Tokyo on May 16th. One of the reasons is that Japan's mega-banks havelumbered off their home territory to pick up some of the slack left by the departingEuropeans (see chart).

欧元危机可能给亚洲的出口导向型经济带来两方面的影响(有可能是相互交叉的):一方面是对欧贸易额减少,另一方面是资金不足,这是欧元区银行延长了贸易信贷和银团贷款的期限导致的。5月16日,在东京举办的经济学家领导人会谈中,亚洲发展银行的lwan Azis认为,尽管如此,亚洲经济却再也不会像2008年雷曼兄弟垮台之后那般脆弱。其中一个原因是,日本的大型银行逐渐跨越本国领域,捡起了打退堂鼓的欧洲人撂下的一些担子。

This is good news not just for Asia's exporters. It also shows a rare stroke of boldness byJapan's big three, Mitsubishi UFJ Group (MUFG), Sumitomo Mitsui, and Mizuho. After pullingback from lending to Asia following the 1998 financial crisis, and then suffering more than adecade of deleveraging by their deflation-sapped customers at home, they can almost smellthe predicament of their European peers. Ken Takamiya of Nomura Securities says that inAustralia, for instance, the mega-banks' lending has recently overtaken that of BNP Paribasand Société Générale, two retreating French banks. It is the same story elsewhere in Asia, hethinks.

这不仅仅对亚洲输出国来说是好事,同时,也是日本银行业三巨头——三菱日联金融集团(MUFG)、三井住友银行、瑞穗银行少有的一次大胆出击。自1998年金融危机之时三巨头停止像亚洲放贷,之后又连续遭受十几年通货紧缩国民减债的困境,他们几乎可以嗅到如今的欧洲同行的窘迫。野村证券的Kentakamiya表示,譬如在澳大利亚,日本大型银行的贷款近期已经超过了呈下滑趋势的两家法国银行——法国巴黎银行和法国兴业银行。他认为,在亚洲其他地区也是如此。

Some of the banks trumpeted their ability to buy discarded European assets abroad, as wellas making fresh loans in Asia, when they released reports on May 15th showing a sharpincrease in profits last fiscal year. These profits largely reflected the sale of big helpings ofJapanese government bonds, but foreign activities help. Mr Takamiya says returns onoverseas assets at MUFG's biggest bank generate about 2.5%, versus less than 1.5% athome.

这些大型银行中,有些在5月15日的报告中展示其在上一财政年度收益剧增,并吹嘘自己购买废弃欧洲资产及在亚洲发放新鲜贷款的能力。这些收益极大地反映出日本政府公债的重要作用,但外事活动也的确有所帮助。Takamiya先生指出,三菱集团最大的银行拥有的海外资产产生的收益占总收益的2.5%,相比之下,国内资产的收益只有1.5%。

There are, however, some impediments to growing further in Asia, and especially to catchingup with Western competitors such as HSBC and Citigroup. Firstly, although the mega-bankshave huge deposits—MUFG has the second-biggest stash in the world—they lackmatching-currency funding to make non-yen loans, and are thinking only gingerly aboutspreading branch networks across Asia, analysts say.

然而,日本大型银行在亚洲的发展道路会遭遇一些阻碍,尤其是想要赶上其西方竞争对手(如汇丰银行和花旗集团)。首先,据有关人士分析,虽然这些大型银行有巨额的存款——MUFG储蓄量为世界第二,但他们缺少货币配对基金来提供非日元贷款;而且对于在亚洲扩展分支网络一事,他们表现得小心翼翼。

Secondly, their ambitions to be more innovative are modest for now. Rival bankers snortthat Japan's lending is “pure balance-sheet”, meaning they make large syndicated andproject-finance loans that are often long-term and low-margin. They lack the moresophisticated and lucrative cash-management, foreign-exchange and other services ofWestern peers.

其次,他们革新的雄心壮志仍旧是不温不火。作为其对手的银行业人士嗤之以鼻地表示,日本贷款是“纯粹的资产负债表”,即他们虽然提供大量银团贷款和项目融资贷款,却经常是长期性且低利润的。他们缺少了西方同行拥有的那些更为复杂、更能赢利的现金管理、外汇交易及其他服务。

Business at home is so lacklustre, however, that they may have little choice but to placebigger bets abroad. And even if prospects for growth in Japan did improve—GDP rose by 1%in the first quarter, beating expectations—the banks would still benefit from diversifying. Soexposed are they to Japanese government bonds that Masaaki Shirakawa, the governor ofthe Bank of Japan, has said the big banks could suffer losses of up to ¥3.5 trillion ($43.5billion) if yields rose by an admittedly lofty one percentage point. That would more than wipeout their combined profit last year.

但是,国内市场太过乏味,日本大型银行不得不向国外市场押下更大的赌注。尽管日本国内经济增长前景的确有所改善——第一季度的GDP上涨1%,超出预期;但多元化经营仍旧会给他们带来诸多利益。日本政府公债对这些银行的影响过大,日本银行理事Masaaki Shirakawa表示,如果利率真的上涨了1%,这些大型银行将会遭受价值3.5亿日元的巨额损失。这比他们去年利润的总和还要多。

8月底,很多高校2015年考研招生简章已经发布,请广大15年考生关注,预计到8月底9月初,2015年全国硕士研究生招生简章会陆续发布完成,新东方在线小编第一时间跟踪发布,请大家收藏关注!另有研究生专业目录、考研参考书等最新考研信息,帮助考生及时了解目标院校招生政策及信息。另有西医综合专业考试

新东方名师考研课程 购买进行中

【英语阅读资料】这里有↑↑↑

资料下载

资料下载

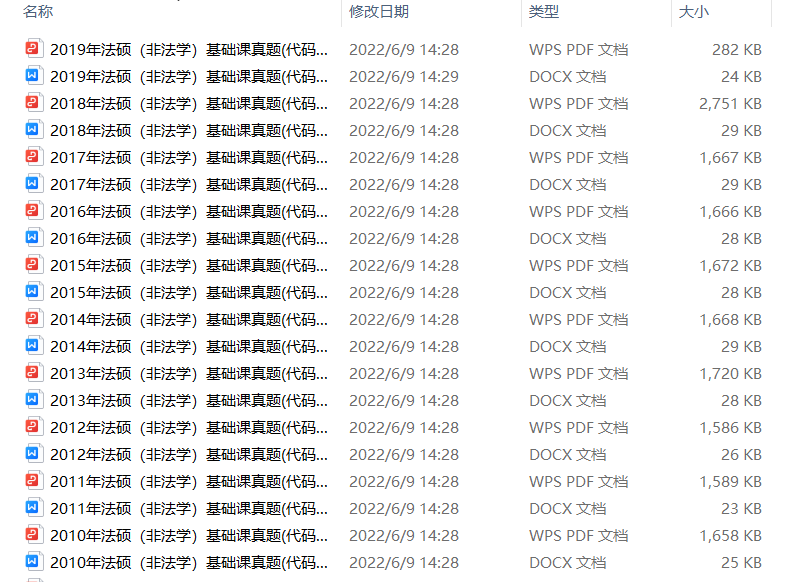

2014年-2025年考研历年真题汇总

发布时间:2024-04-25扫码添加【考研班主任】

即可领取资料包

考研大纲PDF电子版下载-历年(附解析)

发布时间:2024-04-25扫码添加【考研班主任】

即可领取资料包

2026年考研政数英备考资料zip压缩包

发布时间:2024-04-25扫码添加【考研班主任】

即可领取资料包

考研英语大纲词汇5500打印版(基础必备)

发布时间:2024-04-25扫码添加【考研班主任】

即可领取资料包

新东方在线考试模拟题【12套】

发布时间:2024-04-25扫码添加【考研班主任】

即可领取资料包

2026年考研专业课知识点总结

发布时间:2024-04-25扫码添加【考研班主任】

即可领取资料包

新东方考研资料下载地址

发布时间:2023-05-17新东方在线考研资料合集

下载方式:微信扫码,获取网盘链接

目录:

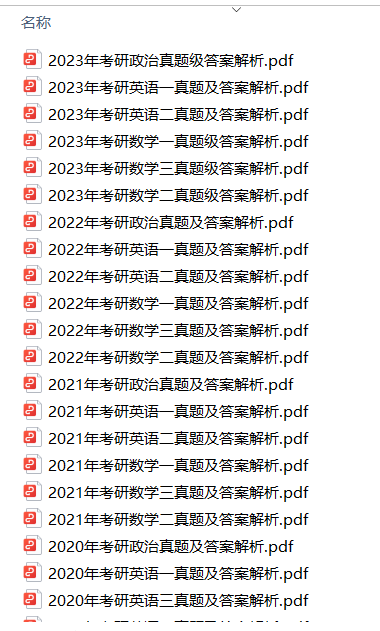

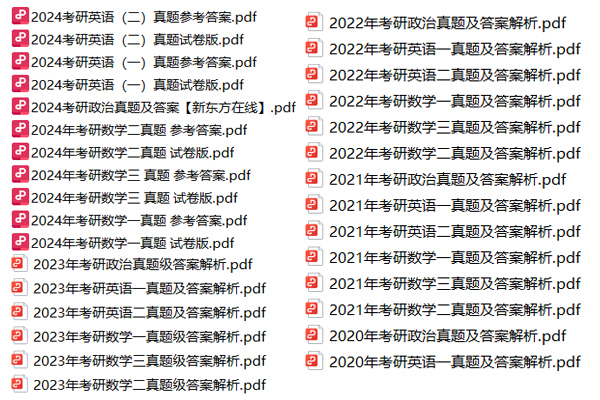

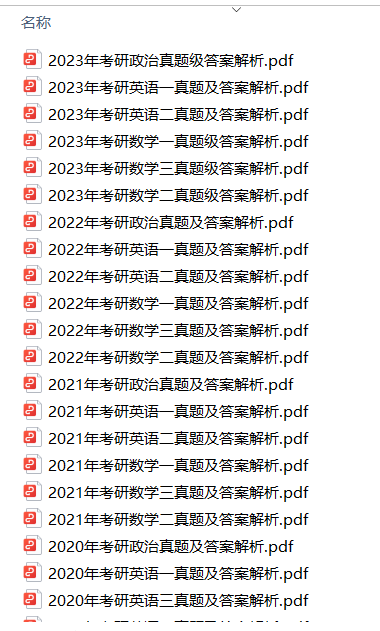

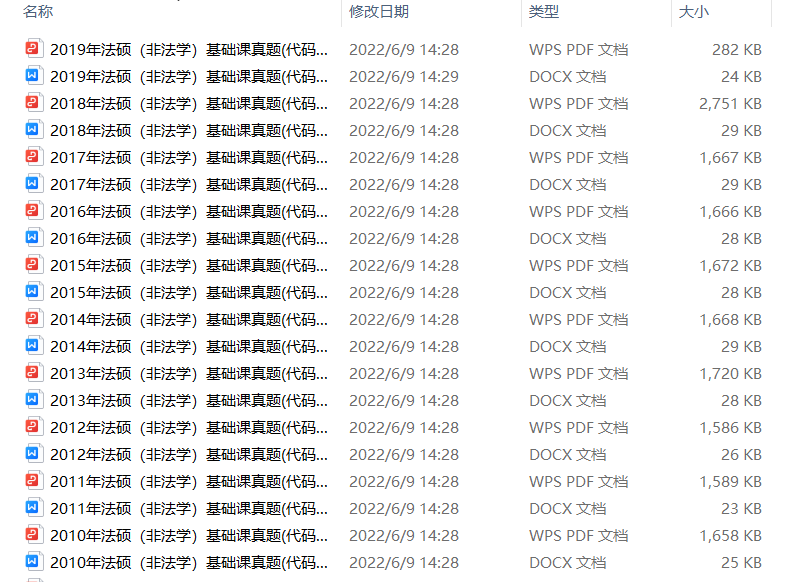

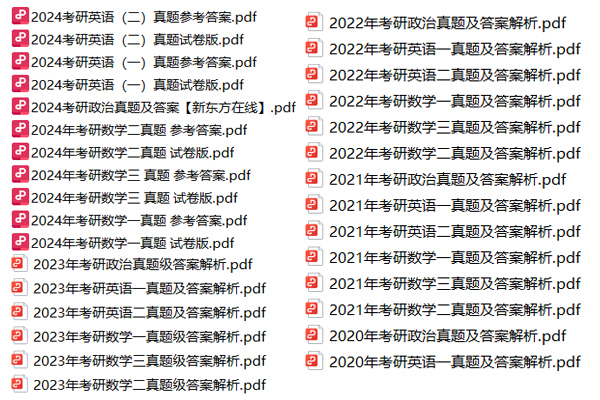

1.2013-2023年近10年政数英真题及解析PDF版(新东方)

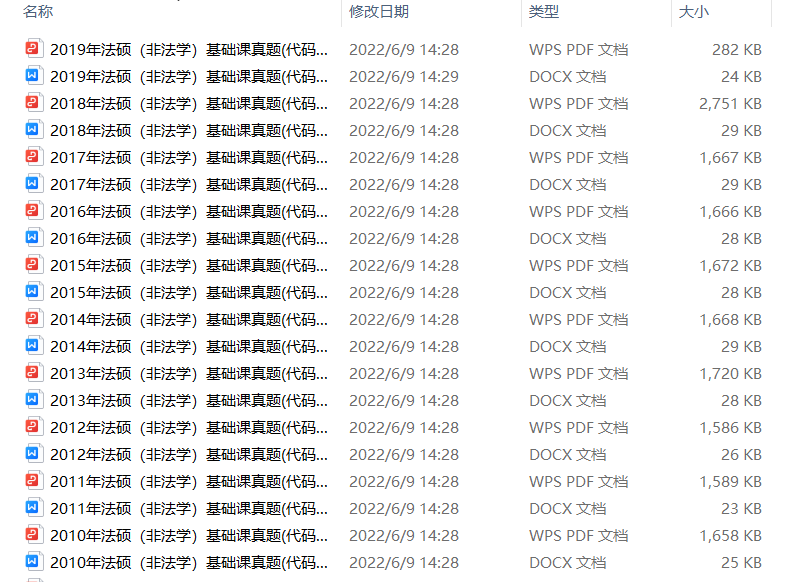

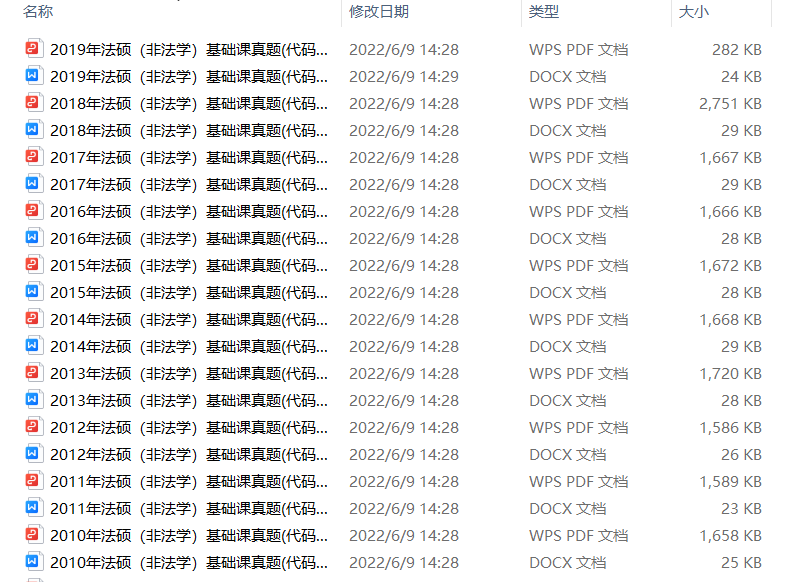

2.2013-2023年专业课考试历年真题及解析PDF版

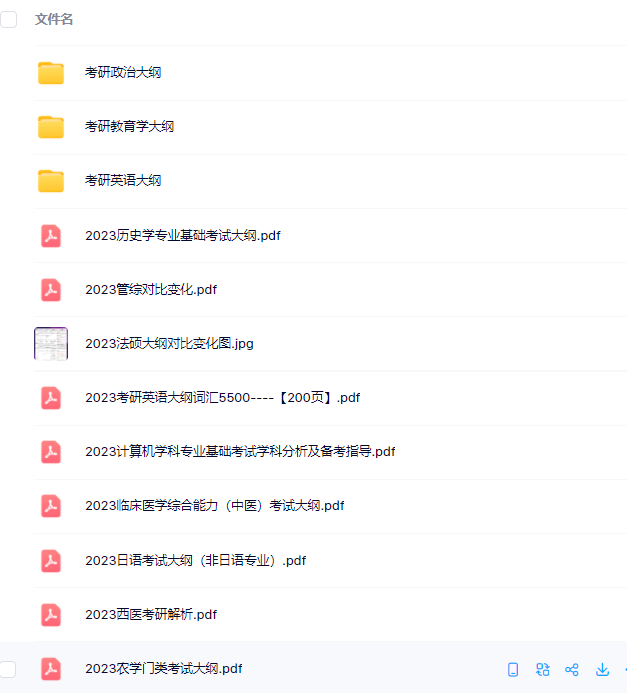

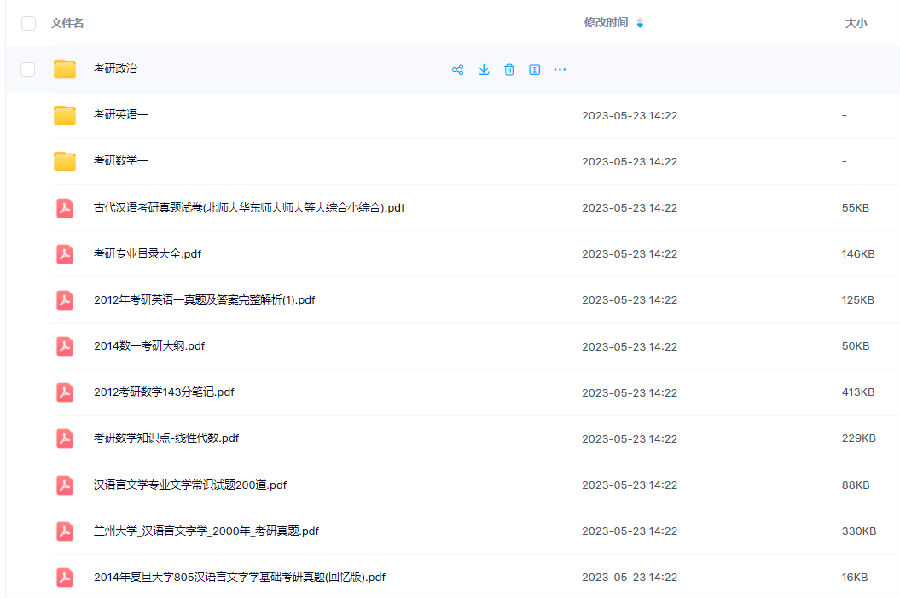

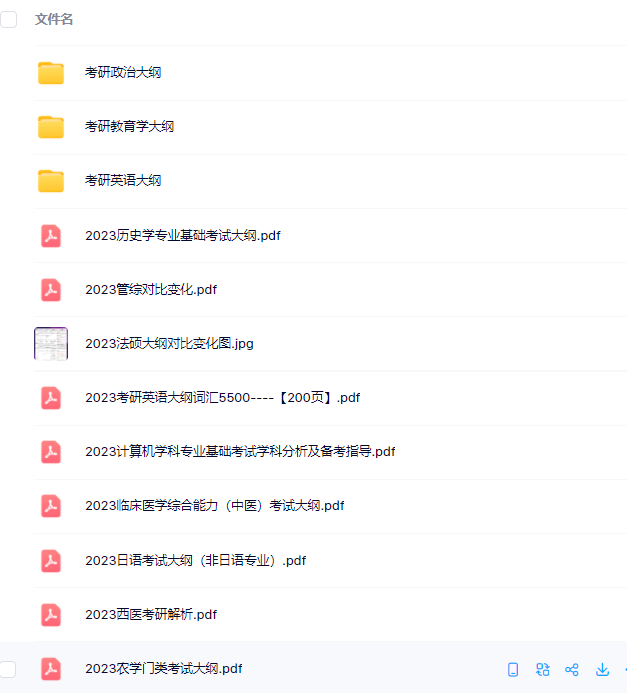

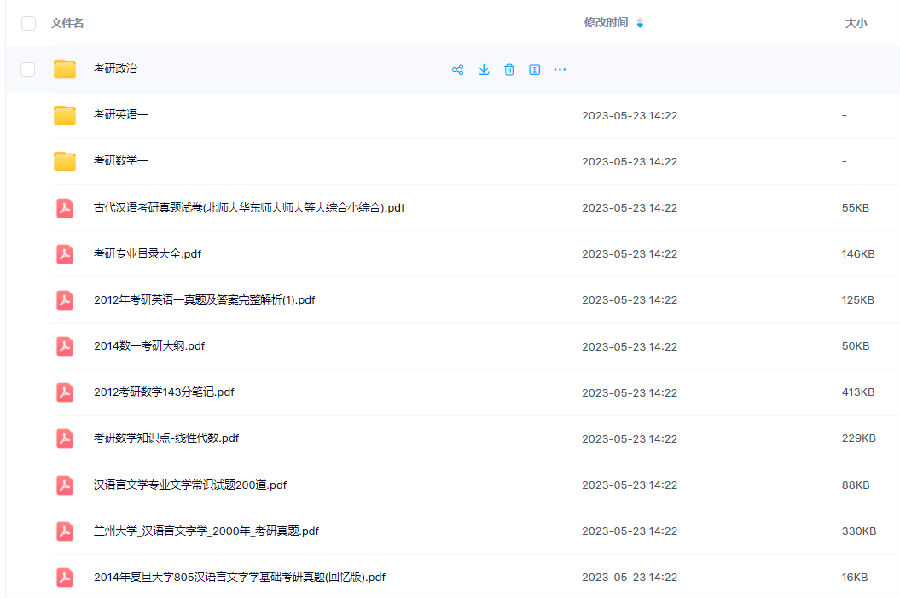

3.24考研复习备考资料大合集:大纲+备考资料+词汇书+考前押题+自命题

资料介绍:

1.2013-2023年近10年政数英真题及解析PDF版(新东方)

、

、

2.2013-2023年专业课考试历年真题及解析PDF版

3.24考研复习备考资料大合集

3.24考研复习备考资料:考研大纲

3.24考研复习备考资料:政数英备考资料+自命题真题

------------------

考研备考过程中,尤其是专业课部分,参考往年的考试真题,对于我们的复习有更好的帮助。北京大学考研真题资料都有哪些?小编为大家进行了汇总。

北京大学考研真题资料-公共课

北京大学考研真题资料-专业课

以上就是关于“北京大学考研真题资料下载(历年汇总)”的整理,更多考研资料下载,请关注微信获取下载地址。

2024考研公共课必背知识点汇总

发布时间:2023-01-03扫码添加【考研班主任】

即可领取资料包

2013-2023考研历年真题汇总

发布时间:2023-01-03扫码添加【考研班主任】

即可领取资料包

考研英语大纲词汇(PDF可打印)

发布时间:2023-01-03扫码添加【考研班主任】

即可领取资料包

2024考研专业课知识点总结

发布时间:2023-01-03扫码添加【考研班主任】

即可领取资料包

2023考研政治 内部押题 PDF

发布时间:2022-11-16扫码添加【考研班主任】

即可领取资料包

徐涛:23考研预测六套卷

发布时间:2022-11-16扫码添加【考研班主任】

即可领取资料包

考研政数英冲刺资料最新整理

发布时间:2022-11-16扫码添加【考研班主任】

即可领取资料包

23考研答题卡模板打印版

发布时间:2022-11-16扫码添加【考研班主任】

即可领取资料包

2023考研大纲词汇5500PDF电子版

发布时间:2022-07-28扫码添加【考研班主任】

即可领取资料包

考研历年真题(公共课+专业课)

发布时间:2022-07-28扫码添加【考研班主任】

即可领取资料包

考研英语阅读100篇附解析及答案

发布时间:2022-01-07扫码添加【考研班主任】

即可领取资料包

新东方考研学霸笔记整理(打印版)

发布时间:2022-01-07扫码添加【考研班主任】

即可领取资料包

2001-2021年考研英语真题答案(可打印版)

发布时间:2022-01-07扫码添加【考研班主任】

即可领取资料包

考研英语词汇5500(完整版下载)

发布时间:2022-01-07扫码添加【考研班主任】

即可领取资料包

2022考研政审表模板精选10套

发布时间:2022-01-07扫码添加【考研班主任】

即可领取资料包

历年考研真题及答案 下载

发布时间:2021-12-09扫码添加【考研班主任】

即可领取资料包

考研政审表模板汇总

发布时间:2020-06-17扫码添加【考研班主任】

即可领取资料包

近5年考研英语真题汇总

发布时间:2020-06-17扫码添加【考研班主任】

即可领取资料包

考研英语大纲词汇5500

发布时间:2020-06-17扫码添加【考研班主任】

即可领取资料包

2022考研12大学科专业排名汇总

发布时间:2019-11-21扫码添加【考研班主任】

即可领取资料包

2023考研政治复习备考资料【珍藏版】

发布时间:2019-11-21扫码添加【考研班主任】

即可领取资料包

考研英语万能模板+必备词汇+范文

发布时间:2019-11-21扫码添加【考研班主任】

即可领取资料包

考研数学一、二、三历年真题整理

发布时间:2019-11-21扫码添加【考研班主任】

即可领取资料包

添加班主任领资料

添加考研班主任

免费领取考研历年真题等复习干货资料

推荐阅读

推荐阅读

为了让考研的同学更高效地复习考研英语,新东方在线考研频道整理了“考研英语1阅读错几个后的复习计划”,考研的同学可以了解一下,希望对大家有所帮助。

为了让考研的同学更高效地复习考研英语,新东方在线考研频道整理了“考研英语二阅读篇数及题型分析”,考研的同学可以了解一下,希望对大家有所帮助。

为了让考研的同学更高效地复习考研英语,新东方在线考研频道整理了“考研英语阅读理解的总结与反思”,考研的同学可以了解一下,希望对大家有所帮助。

来源 : 网络 2025-06-13 08:02:00 关键字 : 考研英语阅读理解

为了让考研的同学更高效地复习考研英语,新东方在线考研频道整理了“提高考研英语一阅读理解的五大策略”,考研的同学可以了解一下,希望对大家有所帮助。

为了让考研的同学更高效地复习考研英语,新东方在线考研频道整理了“探索考研英语阅读文章的逻辑结构”,考研的同学可以了解一下,希望对大家有所帮助。

来源 : 网络 2025-06-12 08:03:00 关键字 : 考研英语阅读

资料下载

资料下载

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

新东方在线考研资料合集

下载方式:微信扫码,获取网盘链接

目录:

1.2013-2023年近10年政数英真题及解析PDF版(新东方)

2.2013-2023年专业课考试历年真题及解析PDF版

3.24考研复习备考资料大合集:大纲+备考资料+词汇书+考前押题+自命题

资料介绍:

1.2013-2023年近10年政数英真题及解析PDF版(新东方)

、

、

2.2013-2023年专业课考试历年真题及解析PDF版

3.24考研复习备考资料大合集

3.24考研复习备考资料:考研大纲

3.24考研复习备考资料:政数英备考资料+自命题真题

------------------

考研备考过程中,尤其是专业课部分,参考往年的考试真题,对于我们的复习有更好的帮助。北京大学考研真题资料都有哪些?小编为大家进行了汇总。

北京大学考研真题资料-公共课

北京大学考研真题资料-专业课

以上就是关于“北京大学考研真题资料下载(历年汇总)”的整理,更多考研资料下载,请关注微信获取下载地址。

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

阅读排行榜

阅读排行榜

相关内容

相关内容