特惠-26考研冲刺

特惠-27考研课

双证-在职硕士

免联考-同等学力

26考研-肖八笔记

26考研-时政刷题

26考研-作文押题

26考研-全套真题

26考研-提前估分

保研-路线图

27考研-智能择校

27考研-英语测评

27考研-新大纲对比

热门-计算机择校

扫码加入训练营

牢记核心词

学习得礼盒

考研历年真题一定要用好,研究好。结合大纲和真题来选择辅导用书是最明智的。本文新东方在线带大家回顾2019考研英语一真题阅读text1参考答案及解析:

Section Ⅱ Reading Comprehension

Part A

Directions:

Read the following four texts. Answer the questions below each text by choosing A, B, C or D. Mark your answers on the ANSWER SHEET. (40 points)

Text 1

Financial regulations in Britain have imposed a rather unusual rule on the bosses of big banks. Starting next year, any guaranteed bonus of top executives could be delayed 10 years if their banks are under investigation for wrongdoing. The main purpose of this “clawback” rule is to hold bankers accountable for harmful risk-taking and to restore public trust in financial institution. Yet officials also hope for a much larger benefit: more long term decision-making not only by banks but also bu all corporations, to build a stronger economy for future generations.

“Short-termism” or the desire for quick profits, has worsened in publicly traded companies, says the Bank of England’s top economist. Andrew Haldane. He quotes a giant of classical economies, Alfred Marshall, in describing this financial impatience as acting like “Children who pick the plums out of their pudding to eat them at once” rather than putting them aside to be eaten last.

The average time for holding a stock in both the United States and Britain, he notes, has dropped from seven years to seven months in recent decades. Transient investors, who demand high quarterly profits from companies, can hinder a firm’s efforts to invest in long-term research or to build up customer loyalty. This has been dubbed “quarterly capitalism”.

In addition, new digital technologies have allowed more rapid trading of equities, quicker use of information, and thus shortens attention spans in financial markers. “There seems to be a predominance of short-term thinking at the expense of long-term investing,” said Commissioner Daniel Gallagher of the US Securities and Exchange Commission in speech this week.

In the US, the Sarbanes-Oxley Act of 2002 has pushed most public companies to defer performance bonuses for senior executives by about a year, slightly helping reduce “short-termism.” In its latest survey of CEO pay, The Wall Street Journal finds that “ a substantial part” of executive pay is now tied to performance.

Much more could be done to encourage “long-termism,” such as changes in the tax code and quicker disclosure of stock acquisitions. In France, shareholders who hold onto a company investment for at least two years can sometimes earn more voting rights in a company.

Within companies, the right compensation design can provide incentives for executives to think beyond their own time at the company and on behalf of all stakeholders. Britain’s new rule is a reminder to bankers that society has an interest in their performance, not just for the short term but for the long term.

21. According to Paragraph 1, one motive in imposing the new rule is the_________.

A. enhance banker’s sense of responsibility

B. help corporations achieve larger profits

C. build a new system of financial regulation

D. guarantee the bonuses of top executives

22. Alfred Marshall is quoted to indicate_________.

A. the conditions for generating quick profits

B. governments’ impatience in decision-making

C. the solid structure of publicly traded companies

D. “short-termism” in economics activities

23. It is argued that the influence of transient investment on public companies can be__________.

A. indirect

B. adverse

C. minimal

D. temporary

24. The US and France examples are used to illustrate____________.

A. the obstacles to preventing “short-termism”.

B. the significance of long-term thinking.

C. the approaches to promoting “long-termism”.

D. the prevalence of short-term thinking.

25. Which of the following would be the best title for the text?

A. Failure of Quarterly Capitalism

B. Patience as a Corporate Virtue

C. Decisiveness Required of Top Executives

D. Frustration of Risk-taking Bankers

21-25参考答案及解析:

21.【A】enhance banker's sense of responsibility;细节题。题目中明确出题段落(According to Paragraph 1)及相应的信息点(one motive in imposing the new rule),因此,答案来源句则为第一段的第三句(The main purpose of this “clawback” rule is to hold bankers accountable for harmful risk-taking and to restore public trust in financial institution这个规则主要目的是让银行家为不良风险负责以及修复公众对金融机构的信任),那么答案基本就很容易提取出来。选项中的“sense of responsibility”则对应到句中的“enhance banker's sense of responsibility(增加银行的责任感)”;而其他的选项则与最佳选项无缘,在定位区间中没有相应的对应信息。

22.【D】 "short-termism" in economic activities;细节题。题干中的定位信息在“Alfred Marshall”上,直接定位到第二段的第二句“He quotes a giant of classical economies, Alfred Marshall, in describing this financial impatience as acting...”,定位信息里的“this financial impatience”则是回指第二段首句的“Short-termism”,故信息点则为“Short-termism”,所以最佳选项则为"short-termism" in economic activities,而其他选项在定位信息中未提及;

23.【B】 adverse;细节题。此题的定位信息为题干的“transient investment”,直接定位到第三段的第二句“Transient investors, who demand high quarterly profits from companies, can hinder a firm’s efforts to invest in long-term research or to build up customer loyalty”,从四个选项的褒贬正负来看indirect、minimal 和temporary为中性的表述,只有B选项的adverse为明确的负面表达,意思为“不利的”,与原文中的“hinder”(阻碍打扰)对应上。

24.【C】the approaches to promoting "long-termism" ;例证题。根据题干的具体信息定位,美国和法国的例子是用来支撑什么论点。原文的第五、六段则提供了具体的信息,第五段中美国延迟发放才上任一年左右的高管绩效津贴,继而促进缓解“短期主义”盛行的现状;第六段则提及在法国持股两年以上者拥有更大的选票权。所以,最佳选项应为“促进长期主义的方法”,与原文一致;

25.【B】Patience as a Corporate Virtue;主旨题。题干中的title为标题题的信息,所以此题考查的是文章的主旨大意;B选项里的patience可以对应到全文中反复出现的主题词“short-termism”和“long-termism”,corporate本身在文章中出现多次,所以B 选项则为最近标题,体现主旨大意;其余选项均不能概括全文,故排除。

【考研英语】资料这里有↑↑↑

本文关键字: 2019考研英语一真题

资料下载

资料下载

2014年-2025年考研历年真题汇总

发布时间:2024-04-25扫码添加【考研班主任】

即可领取资料包

考研大纲PDF电子版下载-历年(附解析)

发布时间:2024-04-25扫码添加【考研班主任】

即可领取资料包

2026年考研政数英备考资料zip压缩包

发布时间:2024-04-25扫码添加【考研班主任】

即可领取资料包

考研英语大纲词汇5500打印版(基础必备)

发布时间:2024-04-25扫码添加【考研班主任】

即可领取资料包

新东方在线考试模拟题【12套】

发布时间:2024-04-25扫码添加【考研班主任】

即可领取资料包

2026年考研专业课知识点总结

发布时间:2024-04-25扫码添加【考研班主任】

即可领取资料包

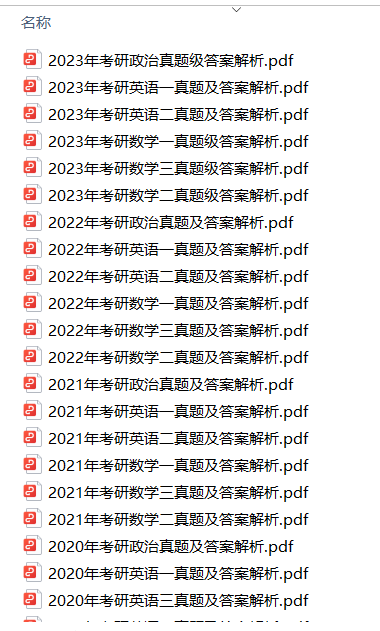

新东方考研资料下载地址

发布时间:2023-05-17新东方在线考研资料合集

下载方式:微信扫码,获取网盘链接

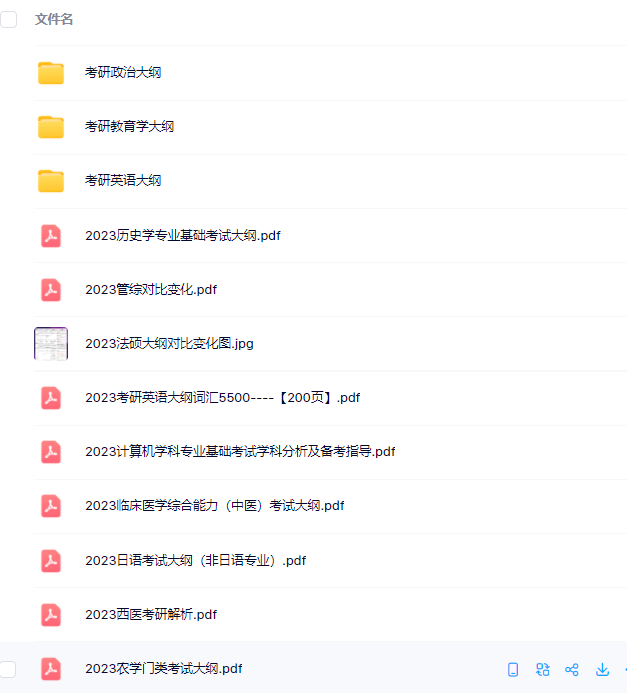

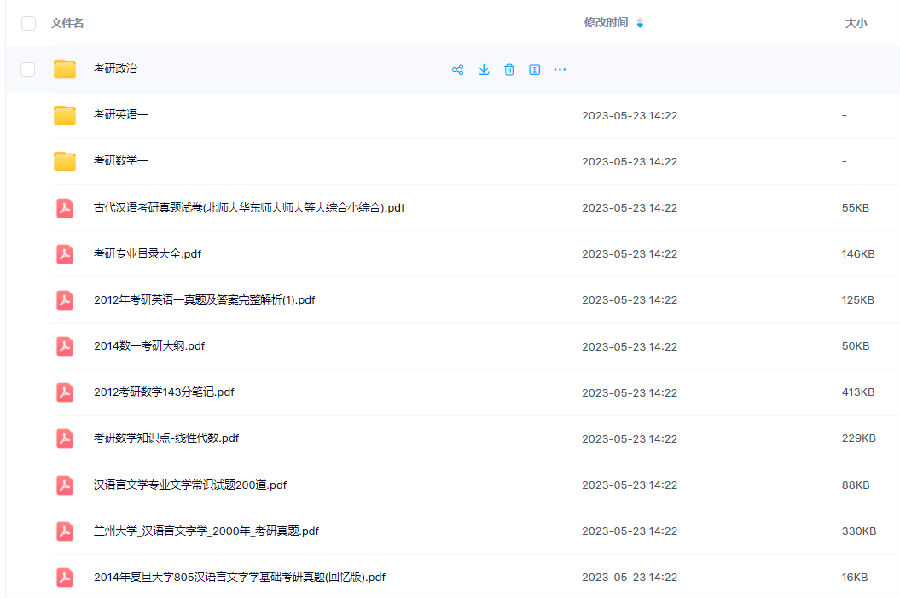

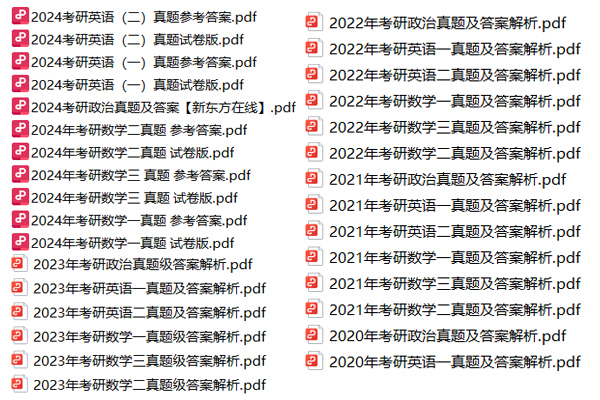

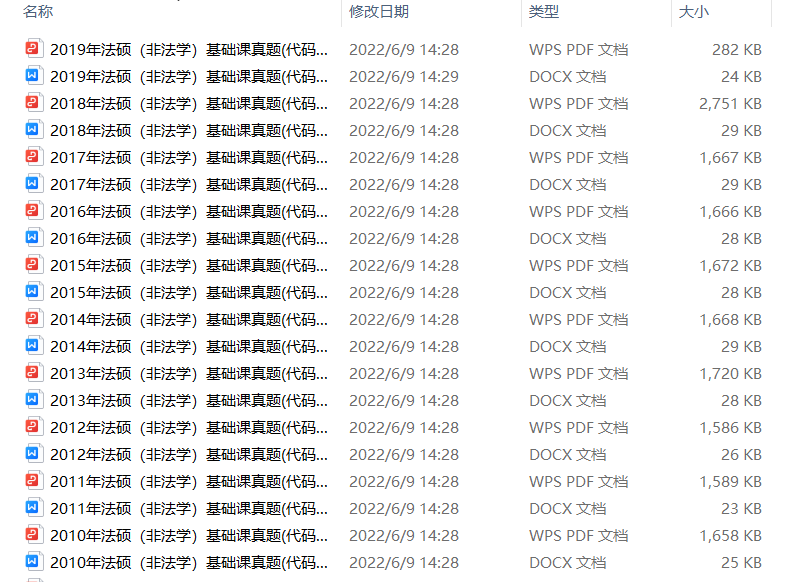

目录:

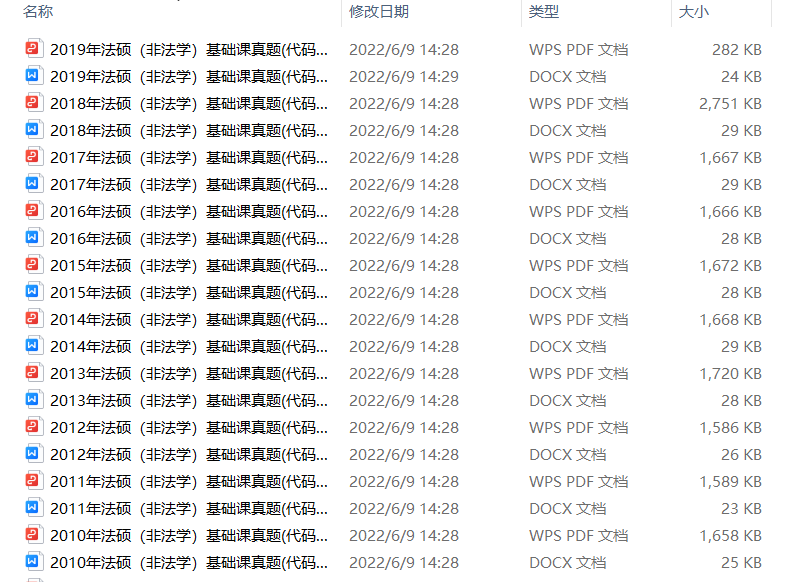

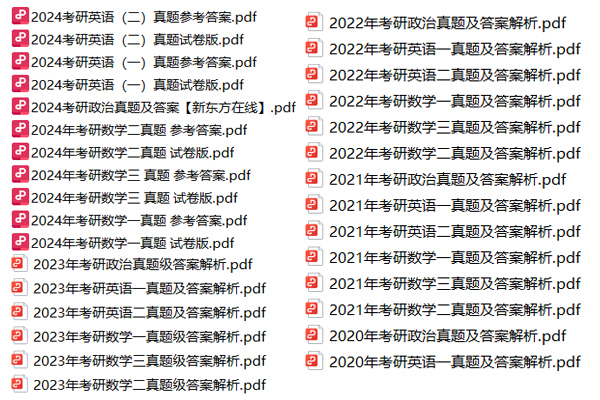

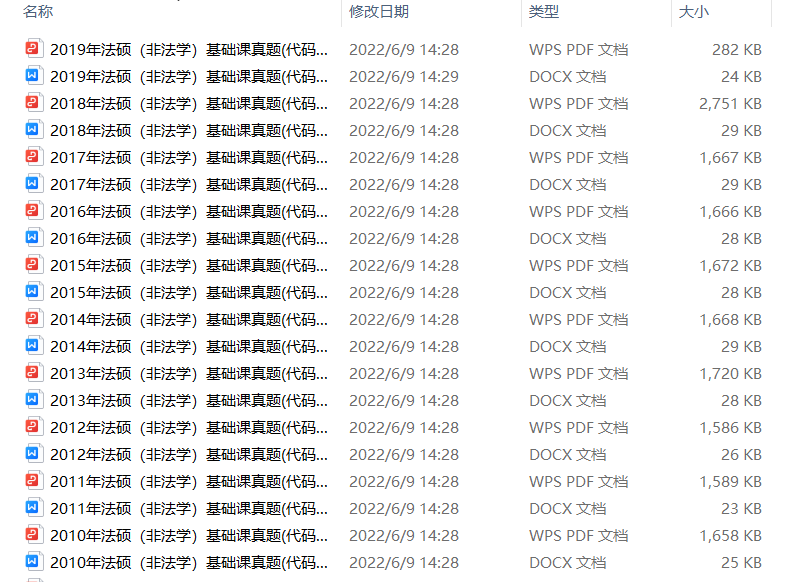

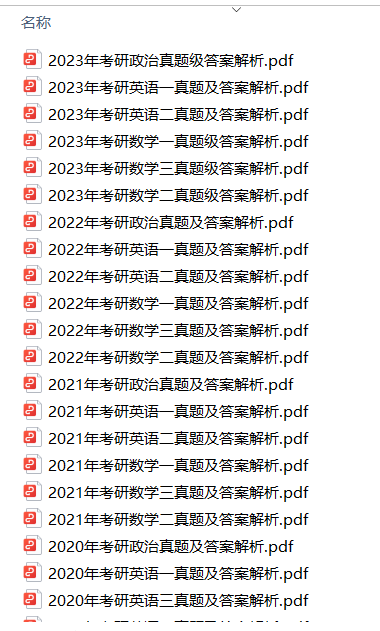

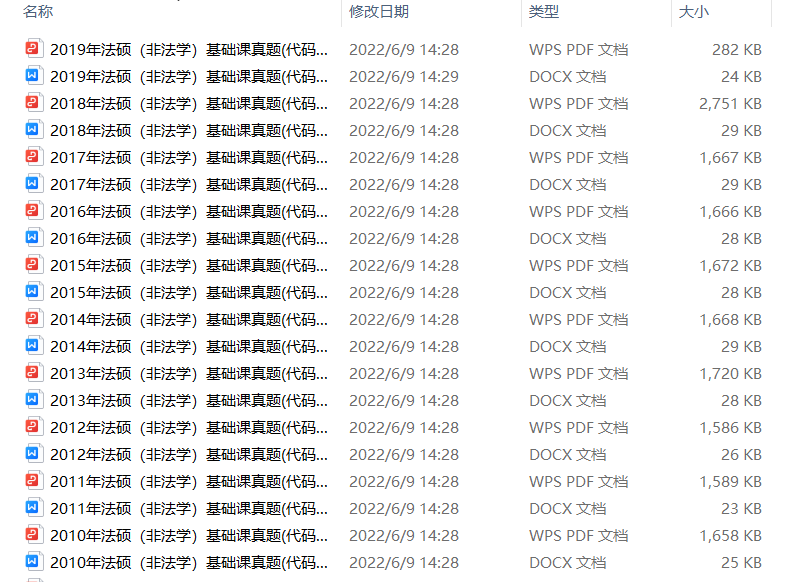

1.2013-2023年近10年政数英真题及解析PDF版(新东方)

2.2013-2023年专业课考试历年真题及解析PDF版

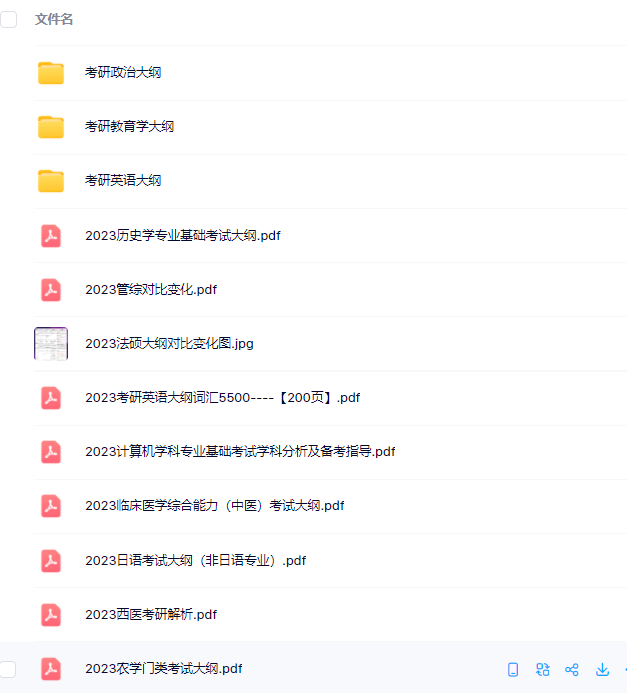

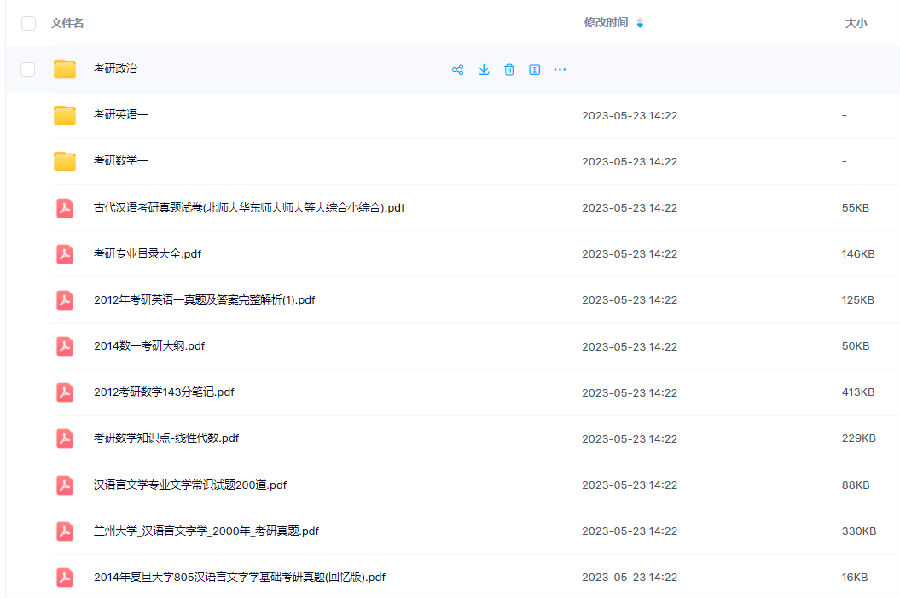

3.24考研复习备考资料大合集:大纲+备考资料+词汇书+考前押题+自命题

资料介绍:

1.2013-2023年近10年政数英真题及解析PDF版(新东方)

、

、

2.2013-2023年专业课考试历年真题及解析PDF版

3.24考研复习备考资料大合集

3.24考研复习备考资料:考研大纲

3.24考研复习备考资料:政数英备考资料+自命题真题

------------------

考研备考过程中,尤其是专业课部分,参考往年的考试真题,对于我们的复习有更好的帮助。北京大学考研真题资料都有哪些?小编为大家进行了汇总。

北京大学考研真题资料-公共课

北京大学考研真题资料-专业课

以上就是关于“北京大学考研真题资料下载(历年汇总)”的整理,更多考研资料下载,请关注微信获取下载地址。

2024考研公共课必背知识点汇总

发布时间:2023-01-03扫码添加【考研班主任】

即可领取资料包

2013-2023考研历年真题汇总

发布时间:2023-01-03扫码添加【考研班主任】

即可领取资料包

考研英语大纲词汇(PDF可打印)

发布时间:2023-01-03扫码添加【考研班主任】

即可领取资料包

2024考研专业课知识点总结

发布时间:2023-01-03扫码添加【考研班主任】

即可领取资料包

2023考研政治 内部押题 PDF

发布时间:2022-11-16扫码添加【考研班主任】

即可领取资料包

徐涛:23考研预测六套卷

发布时间:2022-11-16扫码添加【考研班主任】

即可领取资料包

考研政数英冲刺资料最新整理

发布时间:2022-11-16扫码添加【考研班主任】

即可领取资料包

23考研答题卡模板打印版

发布时间:2022-11-16扫码添加【考研班主任】

即可领取资料包

2023考研大纲词汇5500PDF电子版

发布时间:2022-07-28扫码添加【考研班主任】

即可领取资料包

考研历年真题(公共课+专业课)

发布时间:2022-07-28扫码添加【考研班主任】

即可领取资料包

考研英语阅读100篇附解析及答案

发布时间:2022-01-07扫码添加【考研班主任】

即可领取资料包

新东方考研学霸笔记整理(打印版)

发布时间:2022-01-07扫码添加【考研班主任】

即可领取资料包

2001-2021年考研英语真题答案(可打印版)

发布时间:2022-01-07扫码添加【考研班主任】

即可领取资料包

考研英语词汇5500(完整版下载)

发布时间:2022-01-07扫码添加【考研班主任】

即可领取资料包

2022考研政审表模板精选10套

发布时间:2022-01-07扫码添加【考研班主任】

即可领取资料包

历年考研真题及答案 下载

发布时间:2021-12-09扫码添加【考研班主任】

即可领取资料包

考研政审表模板汇总

发布时间:2020-06-17扫码添加【考研班主任】

即可领取资料包

近5年考研英语真题汇总

发布时间:2020-06-17扫码添加【考研班主任】

即可领取资料包

考研英语大纲词汇5500

发布时间:2020-06-17扫码添加【考研班主任】

即可领取资料包

2022考研12大学科专业排名汇总

发布时间:2019-11-21扫码添加【考研班主任】

即可领取资料包

2023考研政治复习备考资料【珍藏版】

发布时间:2019-11-21扫码添加【考研班主任】

即可领取资料包

考研英语万能模板+必备词汇+范文

发布时间:2019-11-21扫码添加【考研班主任】

即可领取资料包

考研数学一、二、三历年真题整理

发布时间:2019-11-21扫码添加【考研班主任】

即可领取资料包

添加班主任领资料

添加考研班主任

免费领取考研历年真题等复习干货资料

推荐阅读

推荐阅读

为了让考研的同学更高效地复习考研英语,新东方在线考研频道整理了2026考研英语复习四种考研文章展开类型,考研的同学可以了解一下,希望对大家有所帮助。

为了让考研的同学更高效地复习考研英语,新东方在线考研频道整理了2026考研英语复习总分法文章结构分析,考研的同学可以了解一下,希望对大家有所帮助。

为了让考研的同学更高效地复习考研英语,新东方在线考研频道整理了2026考研英语复习议论文行文规则,考研的同学可以了解一下,希望对大家有所帮助。

为了让考研的同学更高效地复习考研英语,新东方在线考研频道整理了2026考研英语复习完型填空主要考查什么,考研的同学可以了解一下,希望对大家有所帮助。

为了让考研的同学更高效地复习考研英语,新东方在线考研频道整理了2026考研英语复习如何复习作文部分,考研的同学可以了解一下,希望对大家有所帮助。

资料下载

资料下载

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

新东方在线考研资料合集

下载方式:微信扫码,获取网盘链接

目录:

1.2013-2023年近10年政数英真题及解析PDF版(新东方)

2.2013-2023年专业课考试历年真题及解析PDF版

3.24考研复习备考资料大合集:大纲+备考资料+词汇书+考前押题+自命题

资料介绍:

1.2013-2023年近10年政数英真题及解析PDF版(新东方)

、

、

2.2013-2023年专业课考试历年真题及解析PDF版

3.24考研复习备考资料大合集

3.24考研复习备考资料:考研大纲

3.24考研复习备考资料:政数英备考资料+自命题真题

------------------

考研备考过程中,尤其是专业课部分,参考往年的考试真题,对于我们的复习有更好的帮助。北京大学考研真题资料都有哪些?小编为大家进行了汇总。

北京大学考研真题资料-公共课

北京大学考研真题资料-专业课

以上就是关于“北京大学考研真题资料下载(历年汇总)”的整理,更多考研资料下载,请关注微信获取下载地址。

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

阅读排行榜

阅读排行榜

相关内容

相关内容