特惠-26考研冲刺

特惠-27考研课

双证-在职硕士

免联考-同等学力

复试分数线

26复试全面指导

模拟复试面试

26考研-全套真题

26考研估分

保研-路线图

27考研-智能择校

27考研-英语测评

27考研-新大纲对比

热门-计算机择校

扫码加入训练营

牢记核心词

学习得礼盒

同等学力英语也是考试的重要科目,想要在实际的考试中收获到高分成绩,大家在日常的备考复习中,需要对这个科目进行重点的复习。那么具体的同等学力英语应该如何备考?小编为大家整理了“2023同等学力英语考前训练14”,供大家参考。

2023同等学力英语考前训练14

The term investment portfolio conjures up visions of the truly rich-the Rockefellers, the Wal Mart Waltons, Bill Gates. But today, everyone from the Philadelphia firefighter, his part time receptionist wife and their three children, to the single Los Angeles lawyer starting out on his own-needs a portfolio.

A portfolio is simply a collection of financial assets. It may include real estate, rare stamps and coins, precious metals and even artworks. But those are for people with expertise. What most of us need to know about are stocks, bonds and cash (including such cash equivalents as money market funds).

How do you decide what part of your portfolio should go to each of the big three? Begin by understanding that stocks pay higher returns but are more risky; bonds and cash pay lower returns but are less risky.

Research by Ibbotson Associates, for example, shows that large company stocks, on average, have returned 11.2 percent annually since 1926. Over the same period, by comparison, bonds have returned an annual average of 5.3 percent and cash, 3.8 percent.

But short term risk is another matter. In 1974, a one year $1000 investment in the stock market would have declined to $735.

With bonds, there are two kinds of risk: that the borrower won´t pay you back and that the money you´ll get won´t be worth very much. The U.S. government stands behind treasury bonds, so the credit risk is almost nil. But the inflation risk remains. Say you buy a $1000 bond maturing in ten years. If inflation averages about seven percent over that time, then the $1000 you receive at maturity can only buy $500 worth of today´s goods.

With cash, the inflation risk is lower, since over a long period you can keep rolling over your CDs every year (or more often). If inflation rises, interest rates rise to compensate.

As a result, the single most important rule in building a portfolio is this: If you don´t need the money for a long time, then put it into stocks. If you need it soon, put it into bonds and cash.

1. This passage is intended to give advice on .

A) how to avoid inflation risks

B) what kinds of bonds to buy

C) how to get rich by investing in stock market

D) how to become richer by spreading the risk

2. The author mentions such millionaires as the Rockefellers and Bill Gates to show that .

A) they are examples for us on our road to wealth

B) a portfolio is essential to financial success

C) they are really rich people

D) they started out on their own

3. Which of the following statements will the author support?

A) Everybody can get rich with some financial assets.

B) The credit risk for treasury bonds is extremely high.

C) It´s no use trying to know the advantages of stocks, bonds and cash.

D) Everybody should realize the importance of distribution of their financial assets.

4. The word "returns" in paragraph three can be best replaced by "."

A) returning journeys

B) profits

C) savings

D) investments

5. The author of the passage points out that .

A) keeping cash is the only way to avoid risks

B) the longer you own a stock, the more you lost

C) the high rate of profit and high rate of risk coexist in stocks

D) the best way to accumulate wealth is by investing in stocks

以上就是为大家整理的“2023同等学力英语考前训练14”,希望大家可以更好的准备同等学力英语考试,在接下来的考试中取得更好的成绩!

本文关键字: 同等学力英语

资料下载

资料下载

2014年-2025年考研历年真题汇总

发布时间:2024-04-25扫码添加【考研班主任】

即可领取资料包

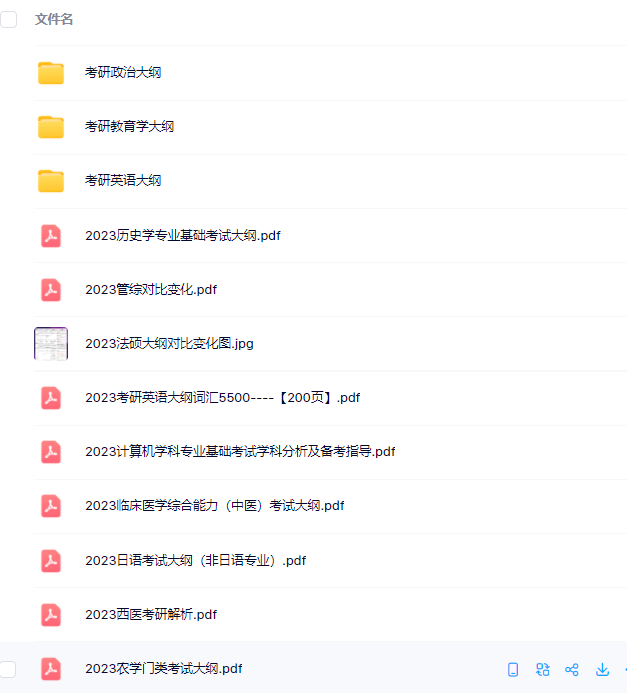

考研大纲PDF电子版下载-历年(附解析)

发布时间:2024-04-25扫码添加【考研班主任】

即可领取资料包

2026年考研政数英备考资料zip压缩包

发布时间:2024-04-25扫码添加【考研班主任】

即可领取资料包

考研英语大纲词汇5500打印版(基础必备)

发布时间:2024-04-25扫码添加【考研班主任】

即可领取资料包

新东方在线考试模拟题【12套】

发布时间:2024-04-25扫码添加【考研班主任】

即可领取资料包

2026年考研专业课知识点总结

发布时间:2024-04-25扫码添加【考研班主任】

即可领取资料包

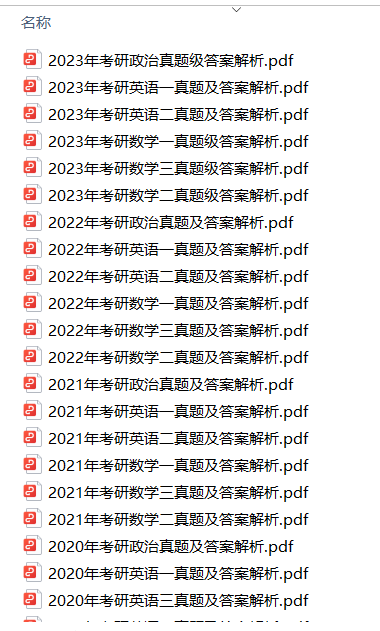

新东方考研资料下载地址

发布时间:2023-05-17新东方在线考研资料合集

下载方式:微信扫码,获取网盘链接

目录:

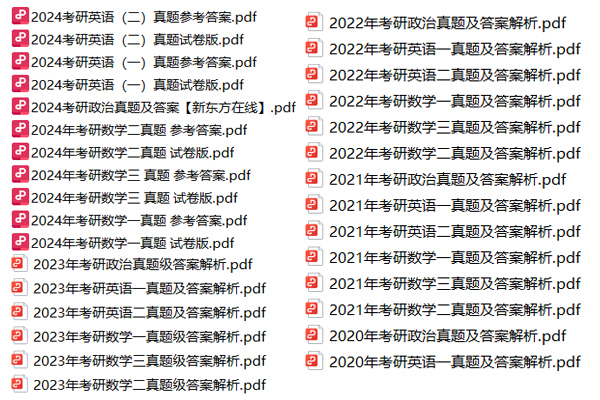

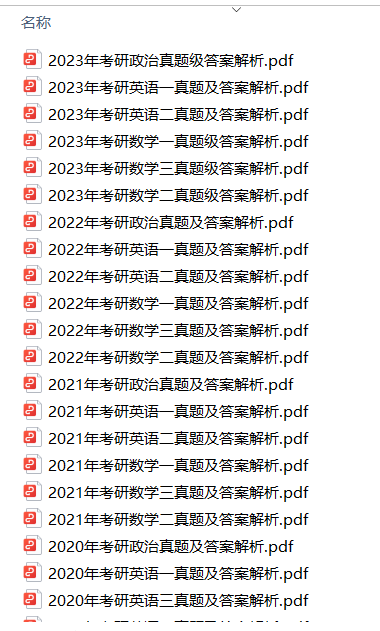

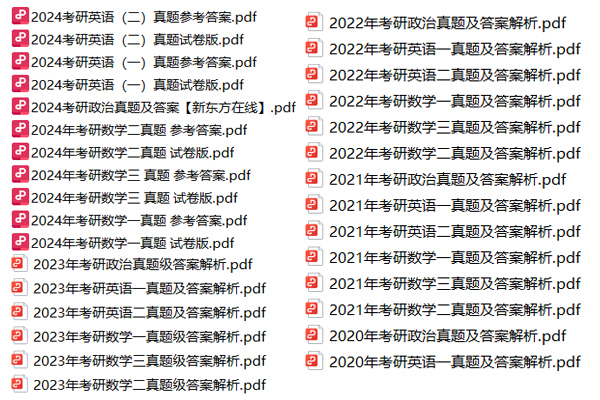

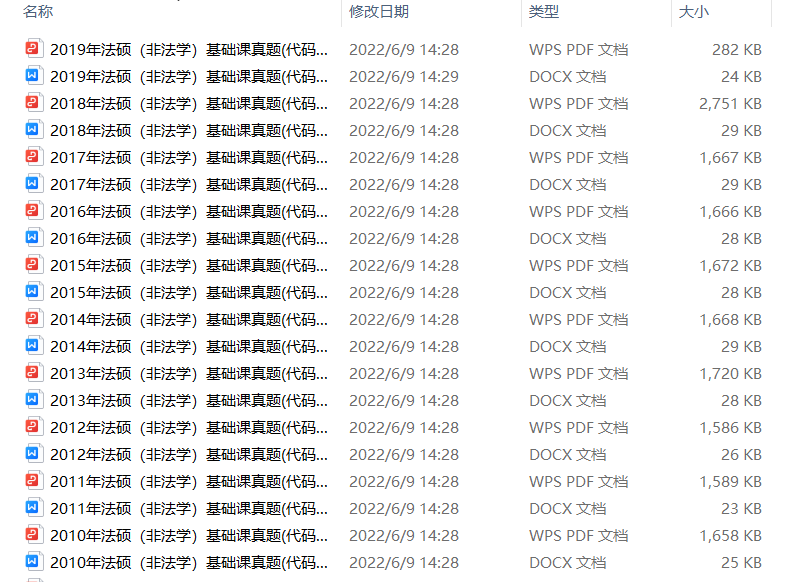

1.2013-2023年近10年政数英真题及解析PDF版(新东方)

2.2013-2023年专业课考试历年真题及解析PDF版

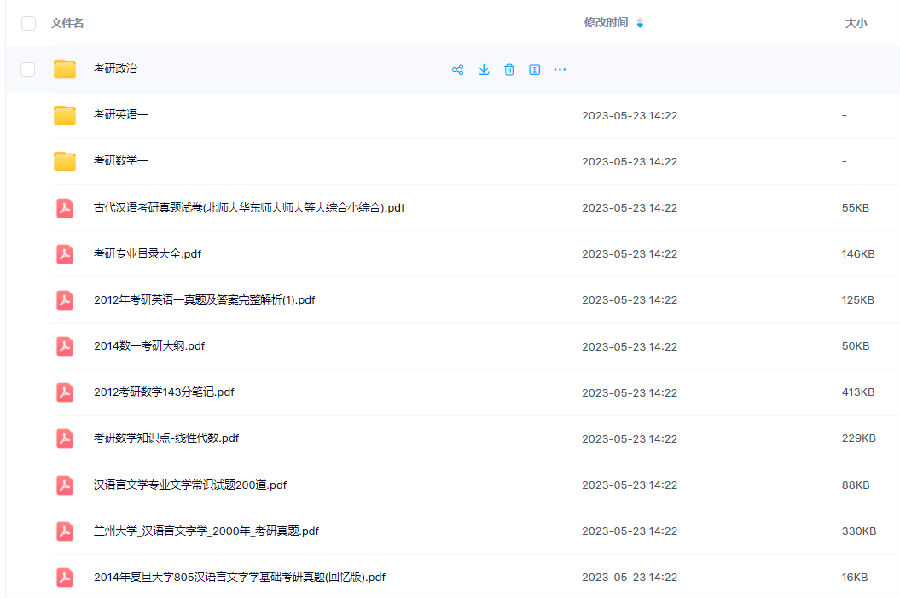

3.24考研复习备考资料大合集:大纲+备考资料+词汇书+考前押题+自命题

资料介绍:

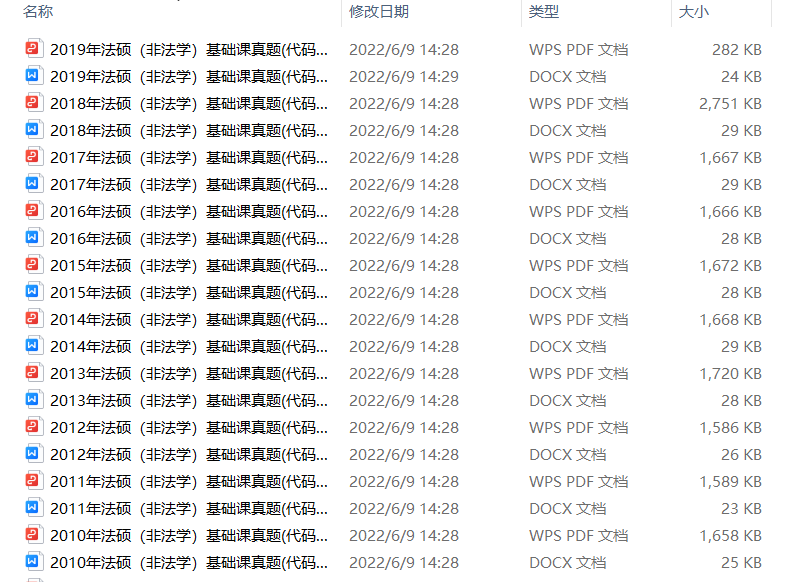

1.2013-2023年近10年政数英真题及解析PDF版(新东方)

、

、

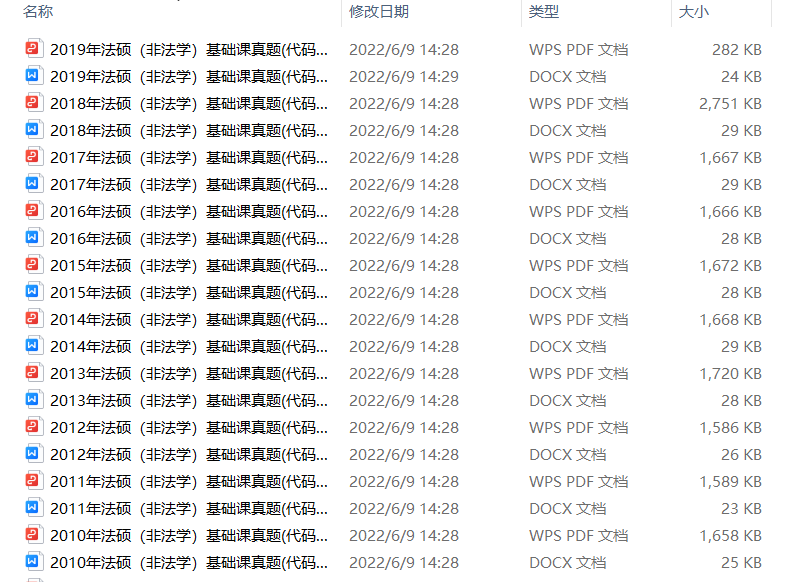

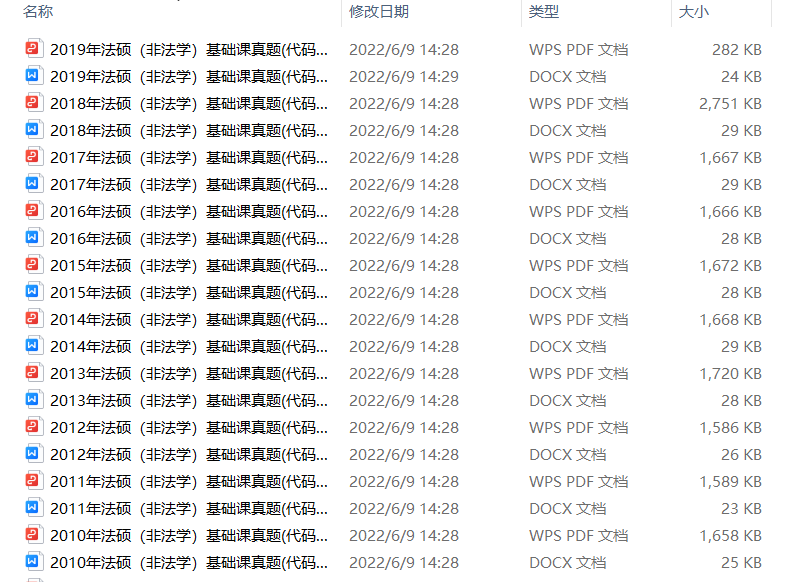

2.2013-2023年专业课考试历年真题及解析PDF版

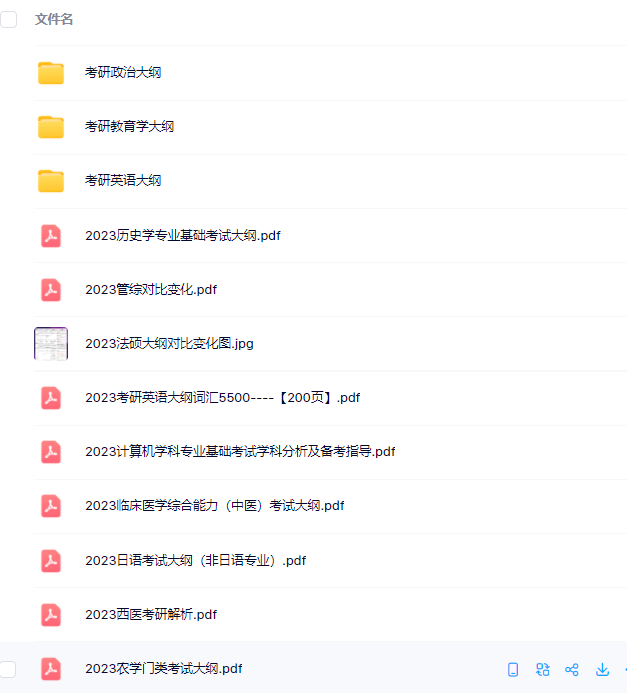

3.24考研复习备考资料大合集

3.24考研复习备考资料:考研大纲

3.24考研复习备考资料:政数英备考资料+自命题真题

------------------

考研备考过程中,尤其是专业课部分,参考往年的考试真题,对于我们的复习有更好的帮助。北京大学考研真题资料都有哪些?小编为大家进行了汇总。

北京大学考研真题资料-公共课

北京大学考研真题资料-专业课

以上就是关于“北京大学考研真题资料下载(历年汇总)”的整理,更多考研资料下载,请关注微信获取下载地址。

2024考研公共课必背知识点汇总

发布时间:2023-01-03扫码添加【考研班主任】

即可领取资料包

2013-2023考研历年真题汇总

发布时间:2023-01-03扫码添加【考研班主任】

即可领取资料包

考研英语大纲词汇(PDF可打印)

发布时间:2023-01-03扫码添加【考研班主任】

即可领取资料包

2024考研专业课知识点总结

发布时间:2023-01-03扫码添加【考研班主任】

即可领取资料包

2023考研政治 内部押题 PDF

发布时间:2022-11-16扫码添加【考研班主任】

即可领取资料包

徐涛:23考研预测六套卷

发布时间:2022-11-16扫码添加【考研班主任】

即可领取资料包

考研政数英冲刺资料最新整理

发布时间:2022-11-16扫码添加【考研班主任】

即可领取资料包

23考研答题卡模板打印版

发布时间:2022-11-16扫码添加【考研班主任】

即可领取资料包

2023考研大纲词汇5500PDF电子版

发布时间:2022-07-28扫码添加【考研班主任】

即可领取资料包

考研历年真题(公共课+专业课)

发布时间:2022-07-28扫码添加【考研班主任】

即可领取资料包

考研英语阅读100篇附解析及答案

发布时间:2022-01-07扫码添加【考研班主任】

即可领取资料包

新东方考研学霸笔记整理(打印版)

发布时间:2022-01-07扫码添加【考研班主任】

即可领取资料包

2001-2021年考研英语真题答案(可打印版)

发布时间:2022-01-07扫码添加【考研班主任】

即可领取资料包

考研英语词汇5500(完整版下载)

发布时间:2022-01-07扫码添加【考研班主任】

即可领取资料包

2022考研政审表模板精选10套

发布时间:2022-01-07扫码添加【考研班主任】

即可领取资料包

历年考研真题及答案 下载

发布时间:2021-12-09扫码添加【考研班主任】

即可领取资料包

考研政审表模板汇总

发布时间:2020-06-17扫码添加【考研班主任】

即可领取资料包

近5年考研英语真题汇总

发布时间:2020-06-17扫码添加【考研班主任】

即可领取资料包

考研英语大纲词汇5500

发布时间:2020-06-17扫码添加【考研班主任】

即可领取资料包

2022考研12大学科专业排名汇总

发布时间:2019-11-21扫码添加【考研班主任】

即可领取资料包

2023考研政治复习备考资料【珍藏版】

发布时间:2019-11-21扫码添加【考研班主任】

即可领取资料包

考研英语万能模板+必备词汇+范文

发布时间:2019-11-21扫码添加【考研班主任】

即可领取资料包

考研数学一、二、三历年真题整理

发布时间:2019-11-21扫码添加【考研班主任】

即可领取资料包

添加班主任领资料

添加考研班主任

免费领取考研历年真题等复习干货资料

推荐阅读

推荐阅读

同等学力英语是考试中的重点,对于备考同等学力申硕考试的同学来说,英语的备考尤其关键,为了帮助大家顺利通过考试,我们为大家整理了

同等学力英语是考试中的重点,对于备考同等学力申硕考试的同学来说,英语的备考尤其关键,为了帮助大家顺利通过考试,我们为大家整理了

同等学力英语是考试中的重点,对于备考同等学力申硕考试的同学来说,英语的备考尤其关键,为了帮助大家顺利通过考试,我们为大家整理了

同等学力英语是考试中的重点,对于备考同等学力申硕考试的同学来说,英语的备考尤其关键,为了帮助大家顺利通过考试,我们为大家整理了

同等学力英语是考试中的重点,对于备考同等学力申硕考试的同学来说,英语的备考尤其关键,为了帮助大家顺利通过考试,我们为大家整理了

资料下载

资料下载

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

新东方在线考研资料合集

下载方式:微信扫码,获取网盘链接

目录:

1.2013-2023年近10年政数英真题及解析PDF版(新东方)

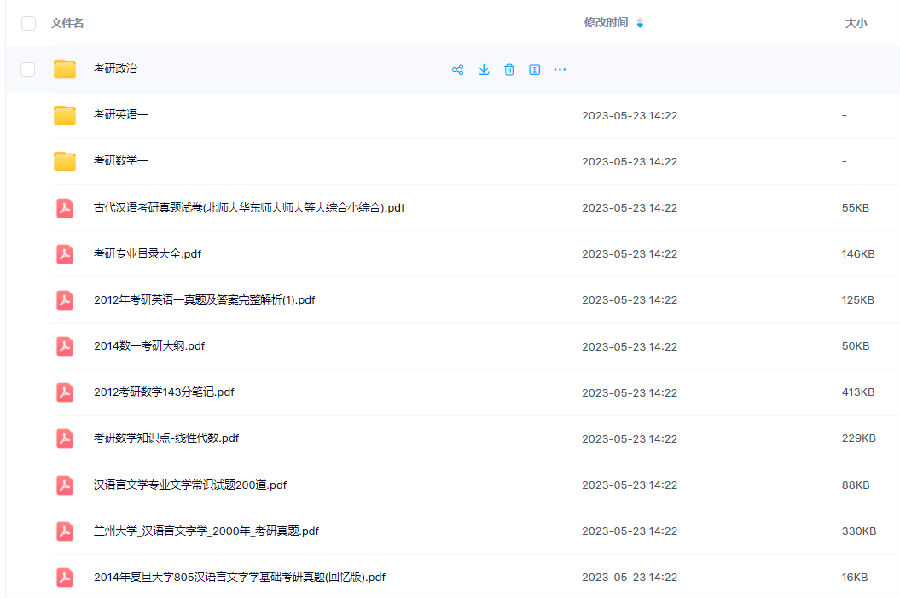

2.2013-2023年专业课考试历年真题及解析PDF版

3.24考研复习备考资料大合集:大纲+备考资料+词汇书+考前押题+自命题

资料介绍:

1.2013-2023年近10年政数英真题及解析PDF版(新东方)

、

、

2.2013-2023年专业课考试历年真题及解析PDF版

3.24考研复习备考资料大合集

3.24考研复习备考资料:考研大纲

3.24考研复习备考资料:政数英备考资料+自命题真题

------------------

考研备考过程中,尤其是专业课部分,参考往年的考试真题,对于我们的复习有更好的帮助。北京大学考研真题资料都有哪些?小编为大家进行了汇总。

北京大学考研真题资料-公共课

北京大学考研真题资料-专业课

以上就是关于“北京大学考研真题资料下载(历年汇总)”的整理,更多考研资料下载,请关注微信获取下载地址。

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

扫码添加【考研班主任】

即可领取资料包

阅读排行榜

阅读排行榜

相关内容

相关内容